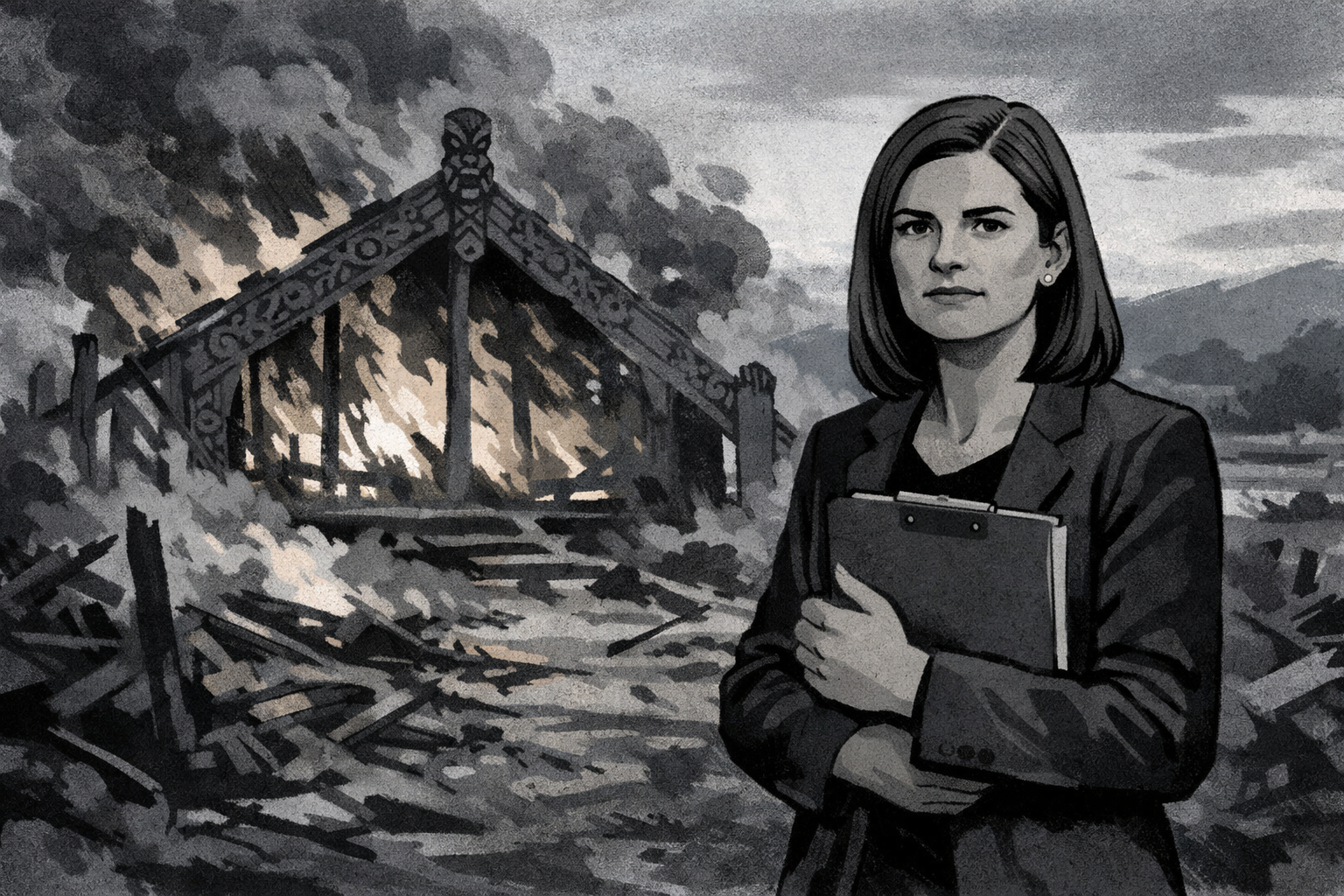

"THE ARSONIST'S AUDIT: How Nicola Willis Is Investigating Her Own Fire While Whānau Choke on the Smoke" - 12 February 2026

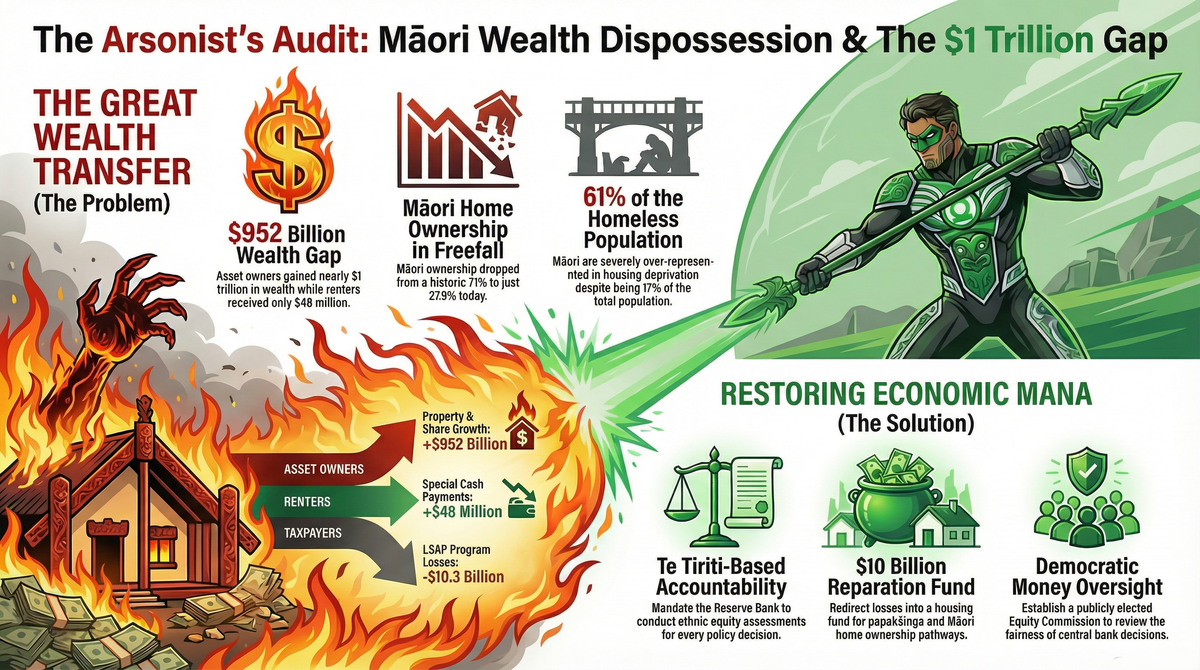

They Burned $55 Billion, Transferred $1 Trillion to the Wealthy, Devastated Māori Home Ownership — and Now They Want a "Review" Weeks Before the Election

https://www.stuff.co.nz/politics/360937122/why-it-took-years-government-investigate-reserve-banks-covid-money; https://www.stuff.co.nz/politics/360936979/government-orders-independent-review-covid-era-monetary-policy

Mōrena koutou katoa. Ko The Māori Green Lantern ahau, e noho ana i roto i Te Arawa, Ngāti Pikiao. Tēnā koutou, tēnā koutou, tēnā koutou katoa.

The Metaphor That Writes Itself

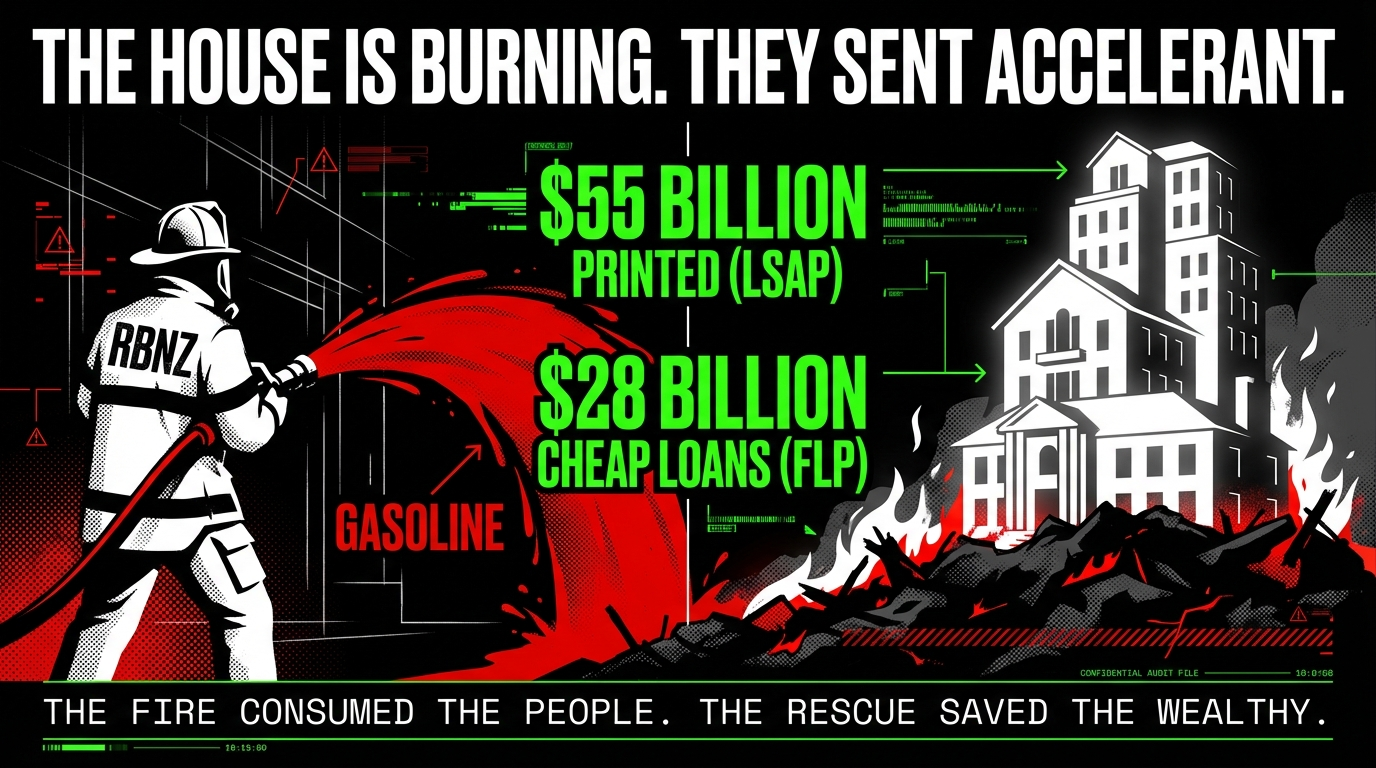

Imagine your house is burning. The firefighters arrive — but instead of water, they pump accelerant onto the blaze. The flames consume everything: your savings, your deposit, your children's future, the mauri of your whānau. The inferno rages for two years. Your neighbours — the ones who already owned fireproof mansions — watch their property values surge in the heat. Insurance companies profit. Banks feast on the embers.

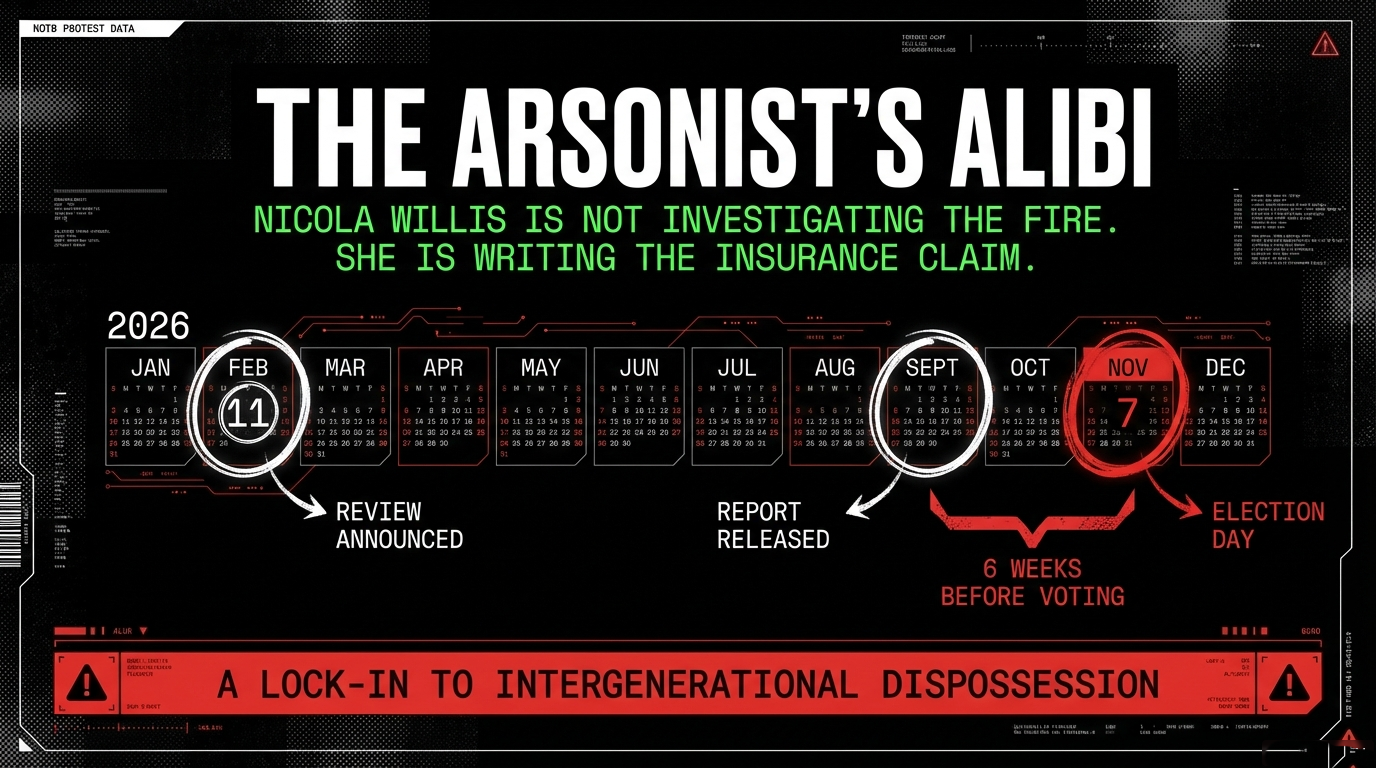

Then, five years later, the arsonist's business partner announces she's launching an "independent review" into why the fire spread so far. The report will land in September — conveniently, six weeks before the election. The reviewers are international. The terms of reference are narrow. And the people who lost everything? They're not even mentioned in the terms of reference.

This is not metaphor. This is what Finance Minister Nicola Willis announced on 11 February 2026, ordering an "independent review" of the Reserve Bank of New Zealand's Covid-era monetary policy — the same policy apparatus that her coalition government has spent two years exploiting, defending, and extending to benefit asset owners while Māori whānau drown.

The fire is real. The accelerant was $55 billion in printed money. The arsonists are still in government. And the audit is the greatest act of political pyromania this country has seen since Ruth Richardson burned the welfare state in 1991.

THE ACCELERANT: What the Reserve Bank Actually Did

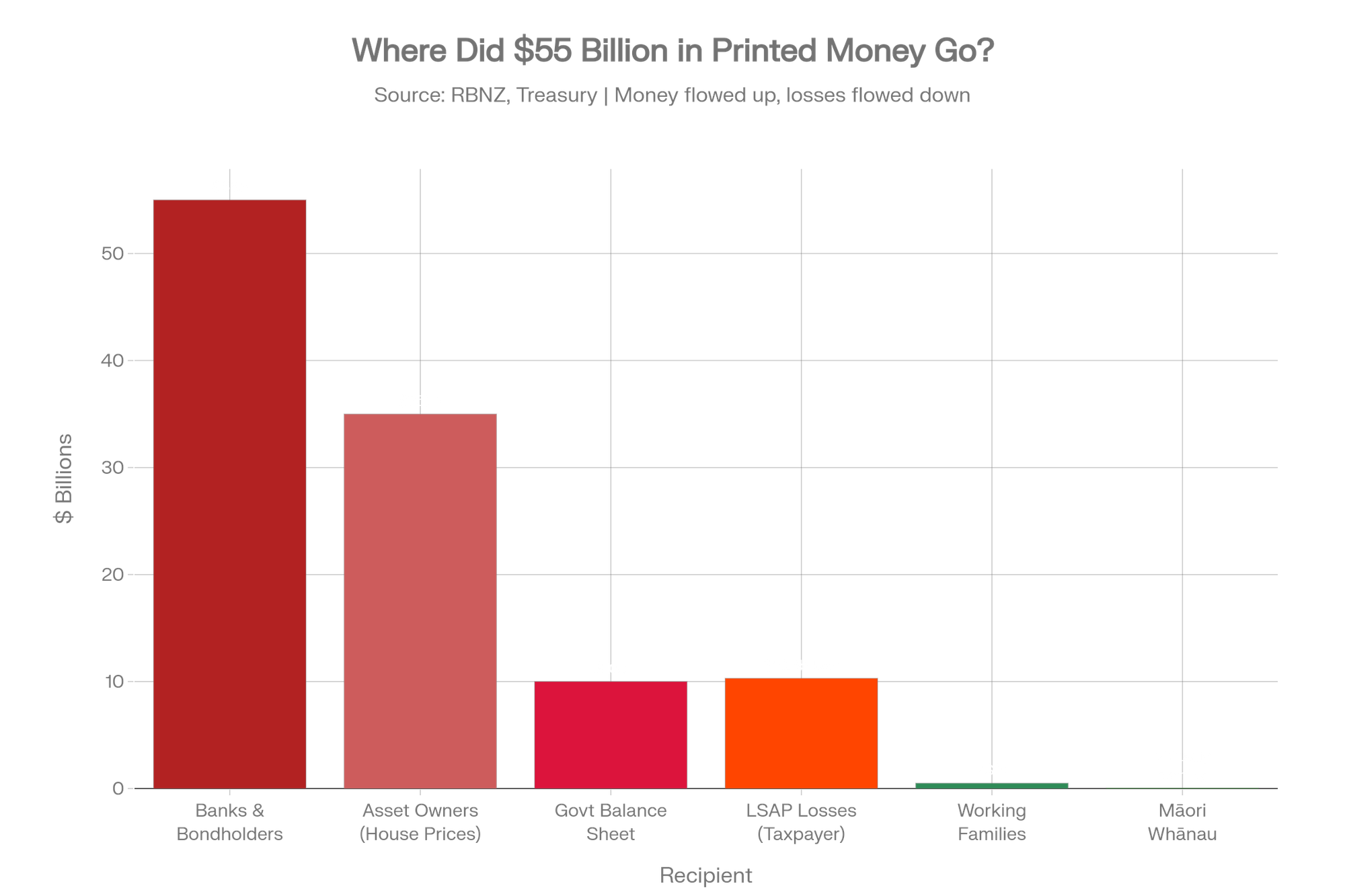

When Covid-19 hit Aotearoa in March 2020, the Reserve Bank slashed the Official Cash Rate to 0.25% and unleashed what it euphemistically called "unconventional monetary tools." In plain language: they printed $53–55 billion through the Large Scale Asset Purchase (LSAP) programme, buying government bonds from private investors. They then added the Funding for Lending Programme (FLP), providing $28 billion in cheap loans directly to banks for on-lending.

The stated purpose? Save jobs. Keep businesses afloat. Prevent a depression.

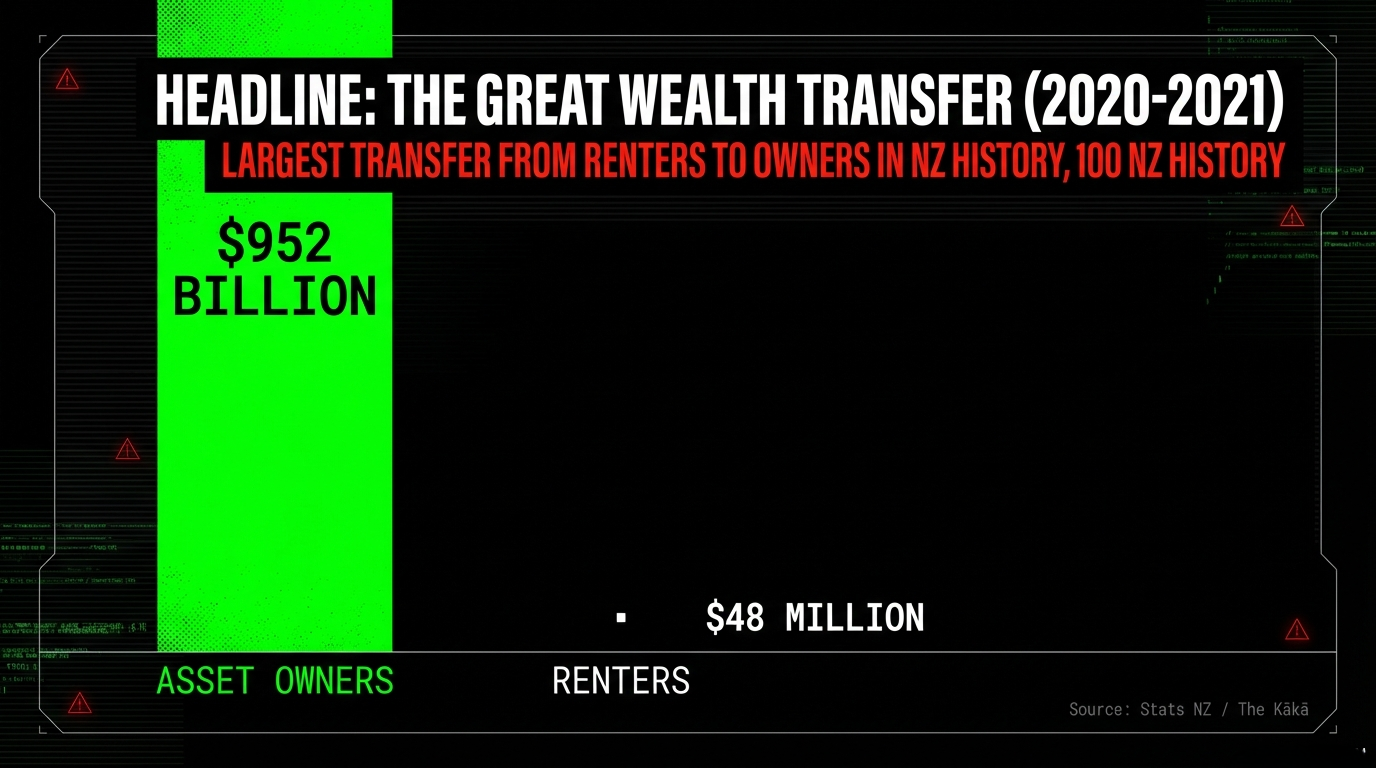

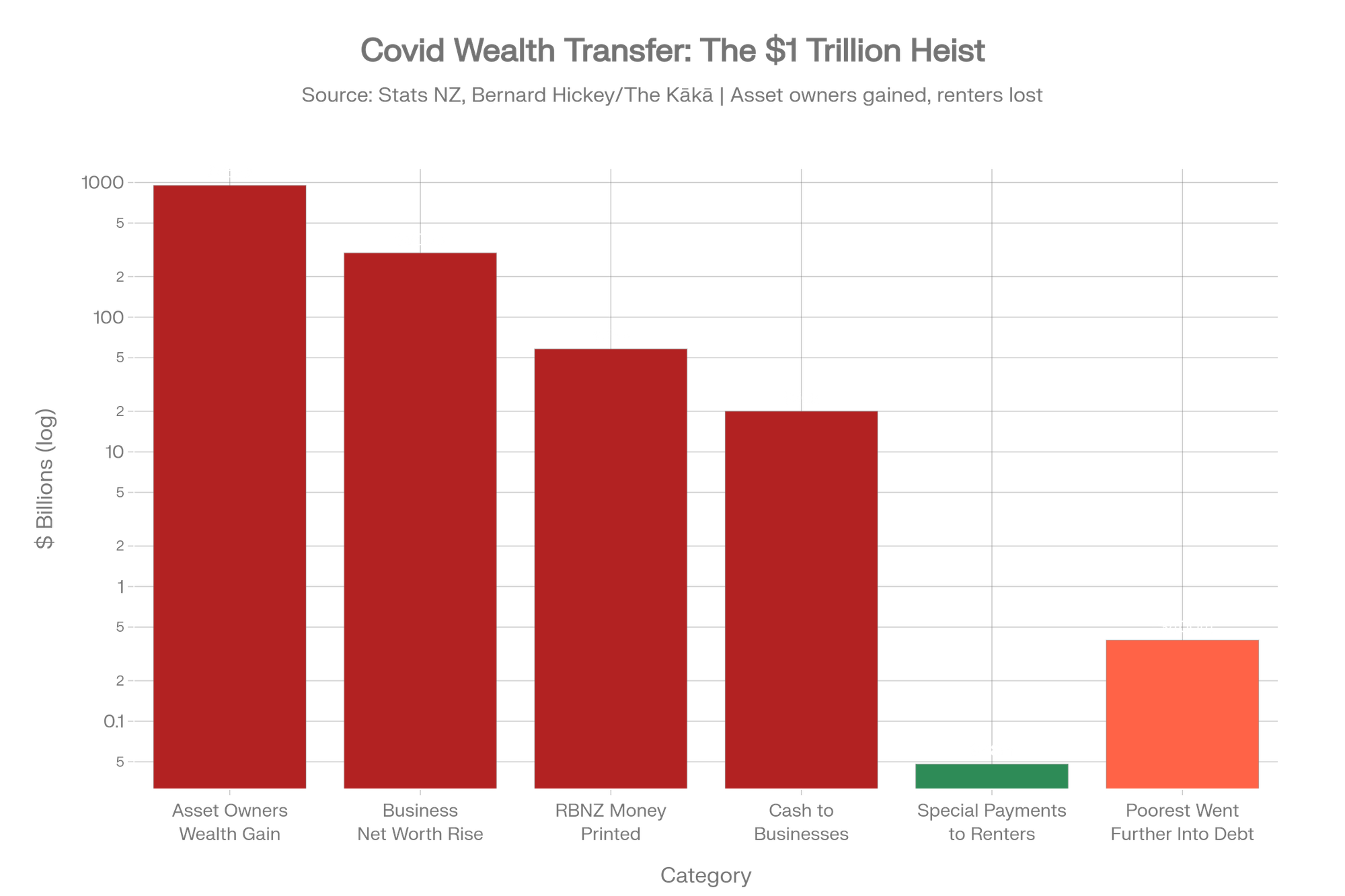

The actual result? The largest transfer of wealth from renters to asset owners in the history of New Zealand. Bernard Hickey, writing in The Kākā, calculated from Stats NZ data that asset owners' wealth rose by $952 billion — nearly $1 trillion — in just 21 months. Household wealth surged from $1.82 trillion in June 2020 to $2.49 trillion by December 2021. House prices exploded 30% in a single year. The LSAP programme itself crystallised $10.3 billion in losses — losses indemnified by taxpayers.

Meanwhile, renters — disproportionately Māori, Pasifika, young, and precarious — received a pittance: $48 million in special cash payments. The poorest went $400 million further into debt to the government itself. Food bank lines doubled. The public housing waitlist surged past 25,000 families.

Covid-era wealth transfer: $952b to asset owners vs $48m to renters

As economist Shamubeel Eaqub told RNZ: "That's where the landed gentry comes in — those who have it have it and their children benefit. But if you're locked out it becomes a generational lockout."

For Māori, this was not a lockout. It was a lock-in — to poverty, to overcrowding, to homelessness, to intergenerational dispossession. A lock-in engineered by the very monetary system this government now pretends to investigate.

THE ARSONIST'S ALIBI: Willis's Cynical Election-Year Theatre

Let us be precise about what Nicola Willis is doing and why.

On 11 February 2026, she announced two international monetary policy experts — Dr Athanasios Orphanides (MIT, former ECB) and David Archer (former RBNZ assistant governor) — to review the RBNZ's pandemic decisions. The review will be completed in August 2026 and publicly released in September 2026 — six weeks before the November 7 election.

Willis claims this is about "learning the lessons of history." She says she waited because she had a "significant work agenda" with the Reserve Bank this term, including refreshing its governance.

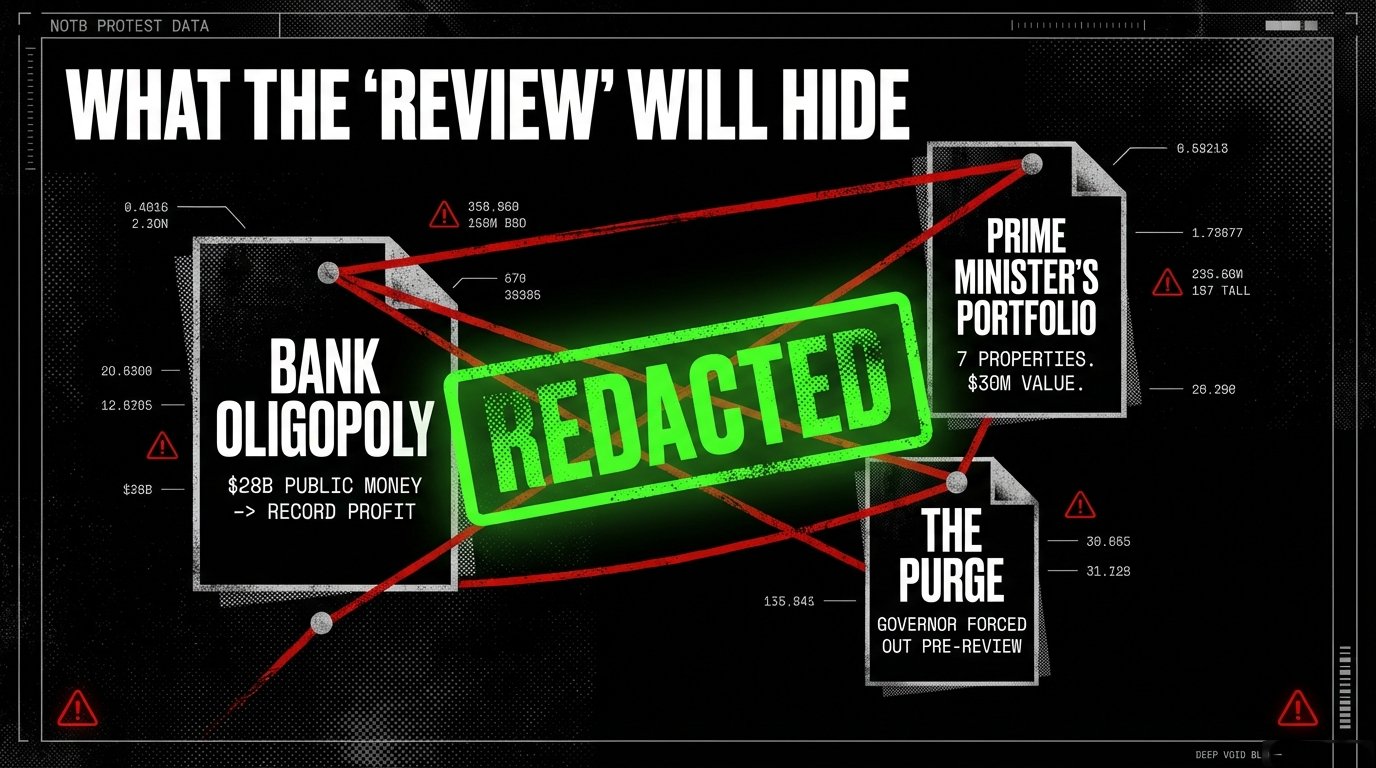

Let us translate from neoliberal to English: she spent two years purging the Reserve Bank — forcing out Governor Adrian Orr, pushing out Board Chair Neil Quigley, installing a new governor, a new board, and a new Monetary Policy Committee — and now, with her handpicked team in place, she launches a review designed to blame the previous government's RBNZ oversight for the economic carnage.

Labour leader Chris Hipkins was blunt: "This is another exercise in cynical political manipulation by Nicola Willis. If she really wanted to know whether the Reserve Bank had handled the pandemic accurately, she would have launched this inquiry when she became Minister of Finance, not right in the middle of an election campaign".

Green co-leader Chlöe Swarbrick called the timing "real sus" and noted "quite dodgy motivations."

Willis's defence? That the Reserve Bank had previously "marked their own homework" in a 2025 self-review. True — the RBNZ's own chief economist Paul Conway admitted they could have tightened monetary policy earlier. But Willis doesn't want accountability. She wants ammunition. The review is a political cruise missile aimed at Labour's record, timed for maximum electoral damage.

The arsonist isn't investigating the fire. She's writing the insurance claim.

THREE EXAMPLES OF QUANTIFIED HARM: The Human Wreckage of Printed Money

Example 1: The First Home Buyer Who Never Was — Hine from South Auckland

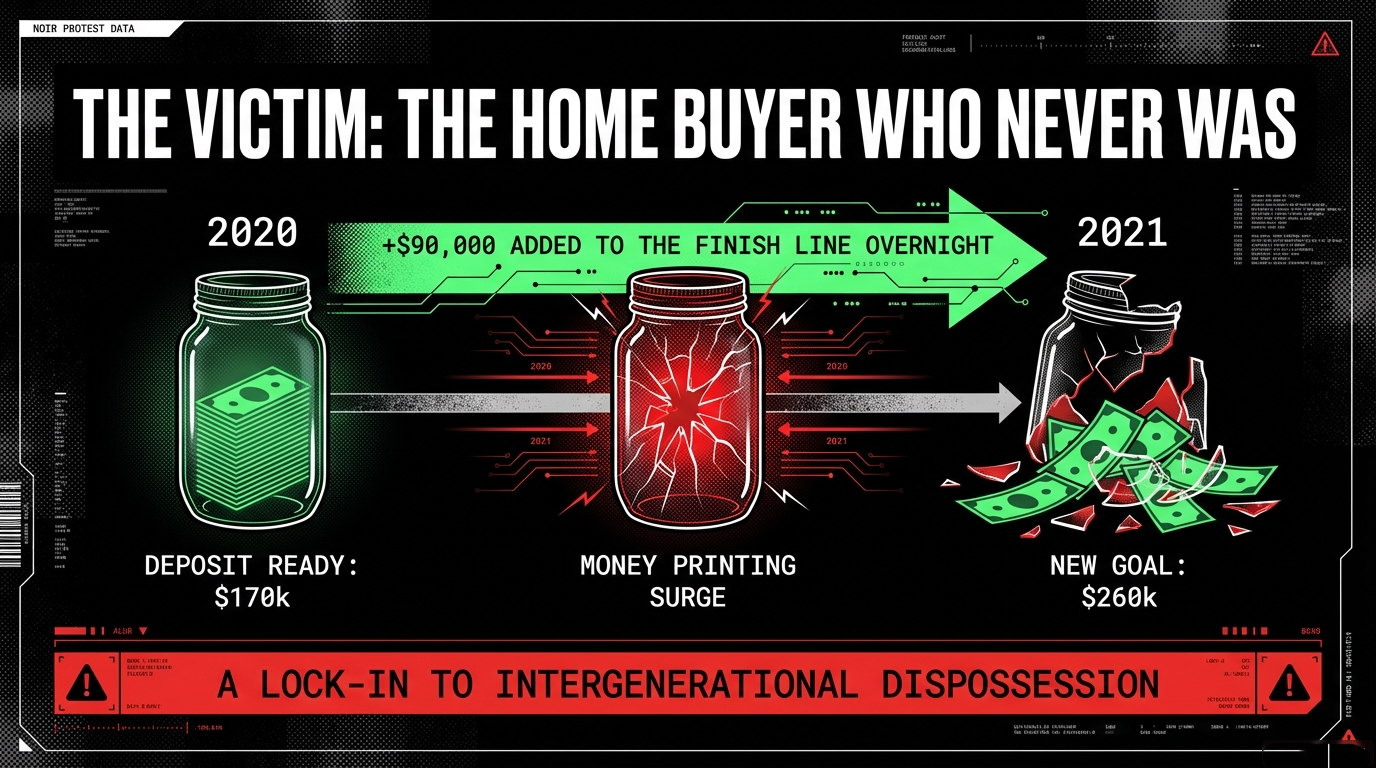

In March 2020, the median house price in Auckland was approximately $850,000. By December 2021, it had surged past $1.3 million — a 30%+ increase in under two years, driven directly by the RBNZ's LSAP programme flooding cheap money into the banking system.

Hine — a composite but representative Māori woman earning $65,000, saving diligently — needed a 20% deposit. Before the money printing, that was $170,000. After? $260,000. The RBNZ's monetary cannon added $90,000 to her deposit requirement overnight. Her five years of saving became worthless. Her dream of home ownership — the foundation of intergenerational wealth — evaporated.

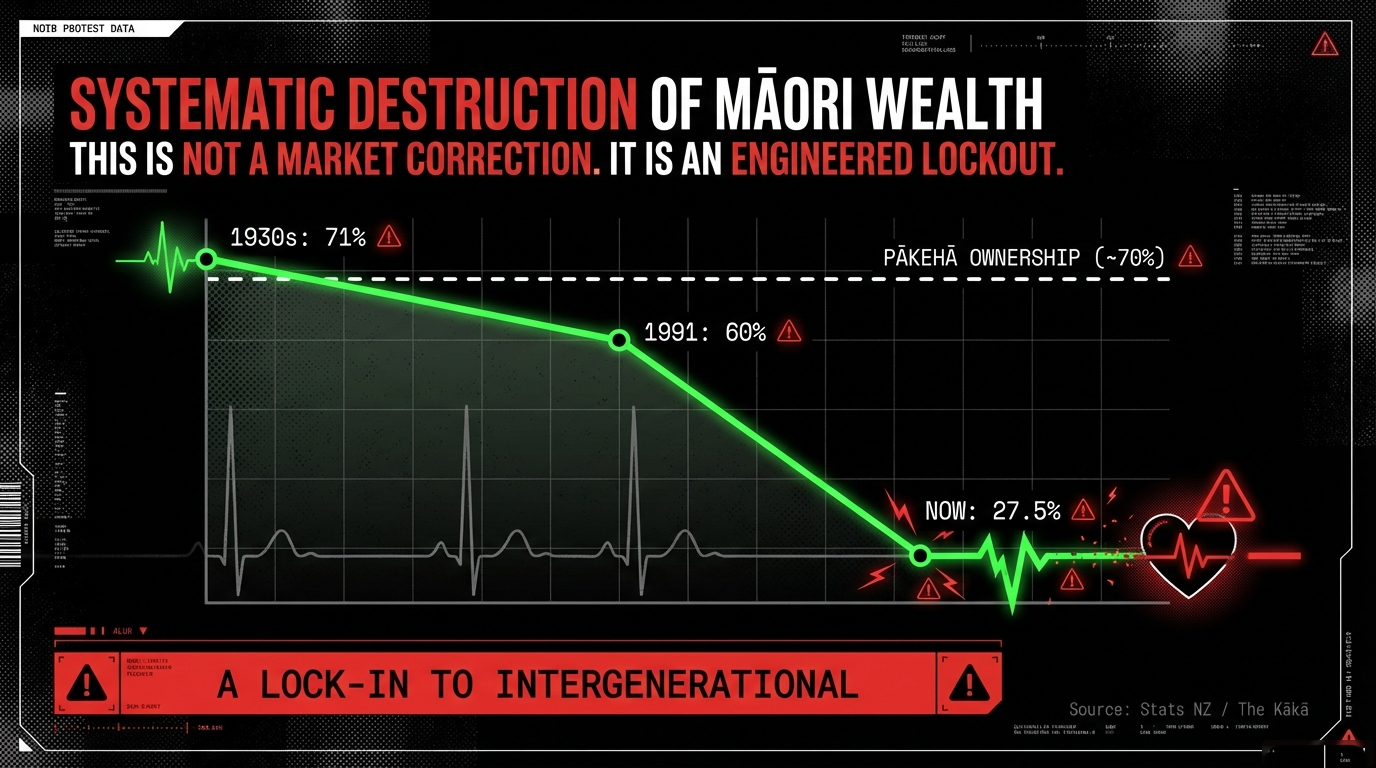

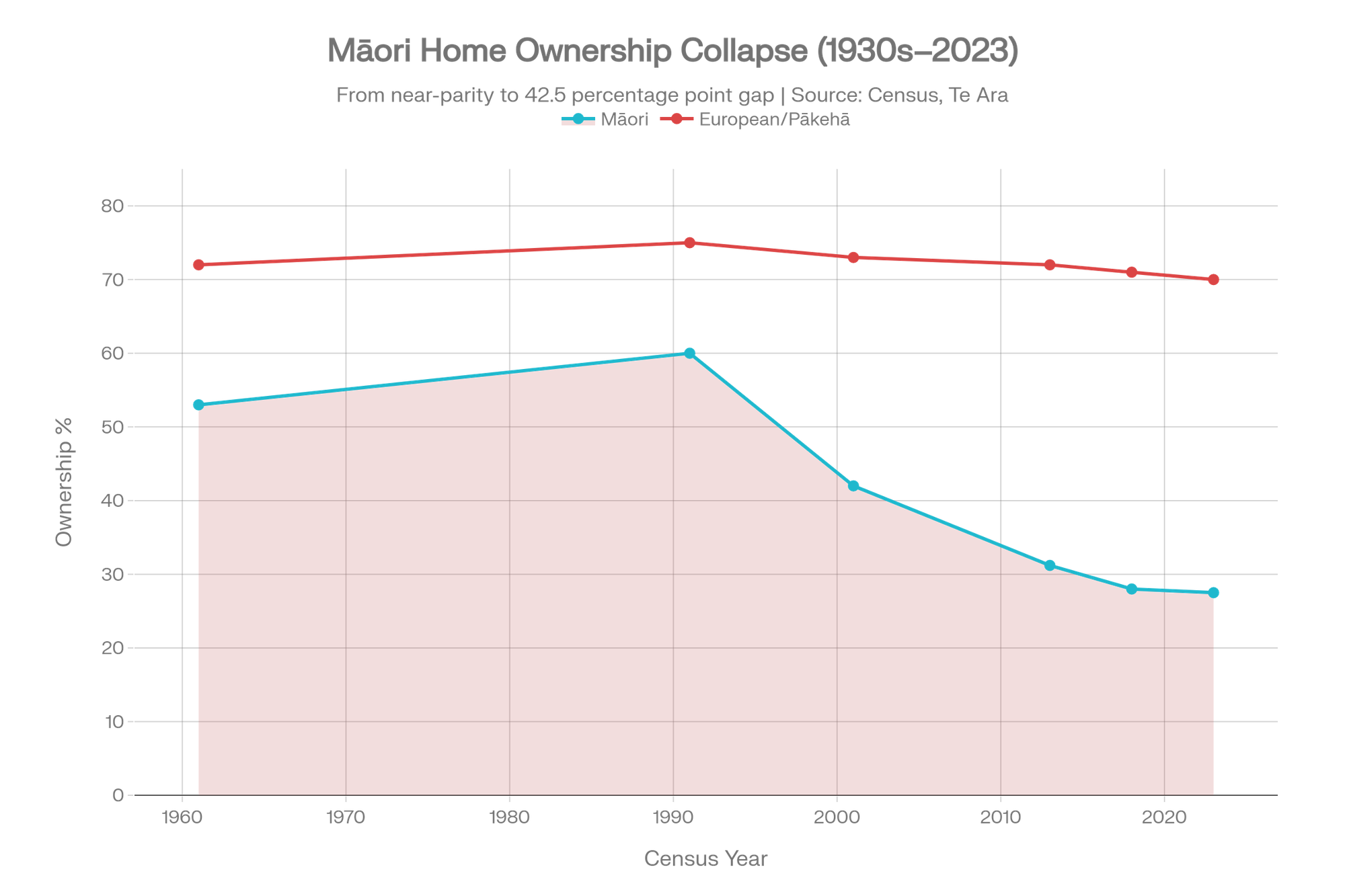

Multiply Hine by thousands. Māori home ownership now sits at 27.5%, down from 31.2% a decade earlier, down from 60% in 1991, down from 71% in the 1930s. Pākehā home ownership? Around 70% — virtually unchanged.

Quantified harm: The 30% house price surge locked an estimated tens of thousands of Māori whānau out of home ownership permanently. Each percentage point of price increase represents approximately $3,000–$8,000 in additional deposit requirements for the median Auckland home. The total wealth lost to Māori through exclusion from the property boom runs into the tens of billions.

Māori home ownership plummeted from 71% to 27.5%

Example 2: The Public Housing Waitlist — 19,431 Families Waiting While Banks Feast

The RBNZ's printed money went first to banks and bondholders, then to mortgage holders and property investors. The Reserve Bank bought $55 billion in bonds from private investors while simultaneously providing $28 billion in cheap lending to the same banks that were tightening criteria for Māori borrowers.

The result: by 2023, over 25,000 households were on the public housing waitlist, with a median wait time of 300 days. As of September 2025, there were still 19,431 applicants on the Housing Register. Māori constituted 49.6% of the waitlist despite being 17% of the population — a nearly three-fold over-representation.

At the 2023 Census, 112,496 people were estimated to be severely housing deprived, with 4,965 living without any shelter. Māori comprised 61% of all homeless people — despite being less than a fifth of the population.

Quantified harm: For every $1 billion the RBNZ printed for bondholders, approximately zero additional social houses were built. The $10.3 billion in LSAP losses alone could have funded approximately 20,000 new social homes at $500,000 each — enough to nearly clear the entire waitlist.

Example 3: The Mortgage Whiplash — Whānau Crushed Between Boom and Bust

The RBNZ's monetary experiment created a vicious whiplash. First, the OCR was slashed to 0.25% and money was printed to drive interest rates to historic lows. Whānau who managed to scrape into the housing market at inflated prices were given mortgages at rates around 2.5–3%.

Then, when the inflation the RBNZ had fuelled came roaring back, the Bank began the most aggressive tightening cycle in its history: eleven consecutive rate hikes, pushing the OCR to 5.25% by April 2023. Nicola Willis, then in opposition, called each hike "another punch in the guts" for mortgage holders.

The Reserve Bank itself warned that a 30% fall in house prices could push 10% of all outstanding mortgage debt into negative equity. House prices fell approximately 18% from peak. Whānau who bought at the top were trapped — owing more than their homes were worth, paying mortgage rates double what they'd been promised.

Quantified harm: An estimated 10,000+ households entered negative equity territory. For Māori first-home buyers who entered at the peak, typical negative equity positions ranged from $50,000 to $150,000 — destroying the very intergenerational wealth pathway that monetary policy supposedly protected.

$55 billion in printed money flowed to banks and asset owners

THE IMPACT ON TIKANGA: Translating Colonial Economic Violence for the Western Mind

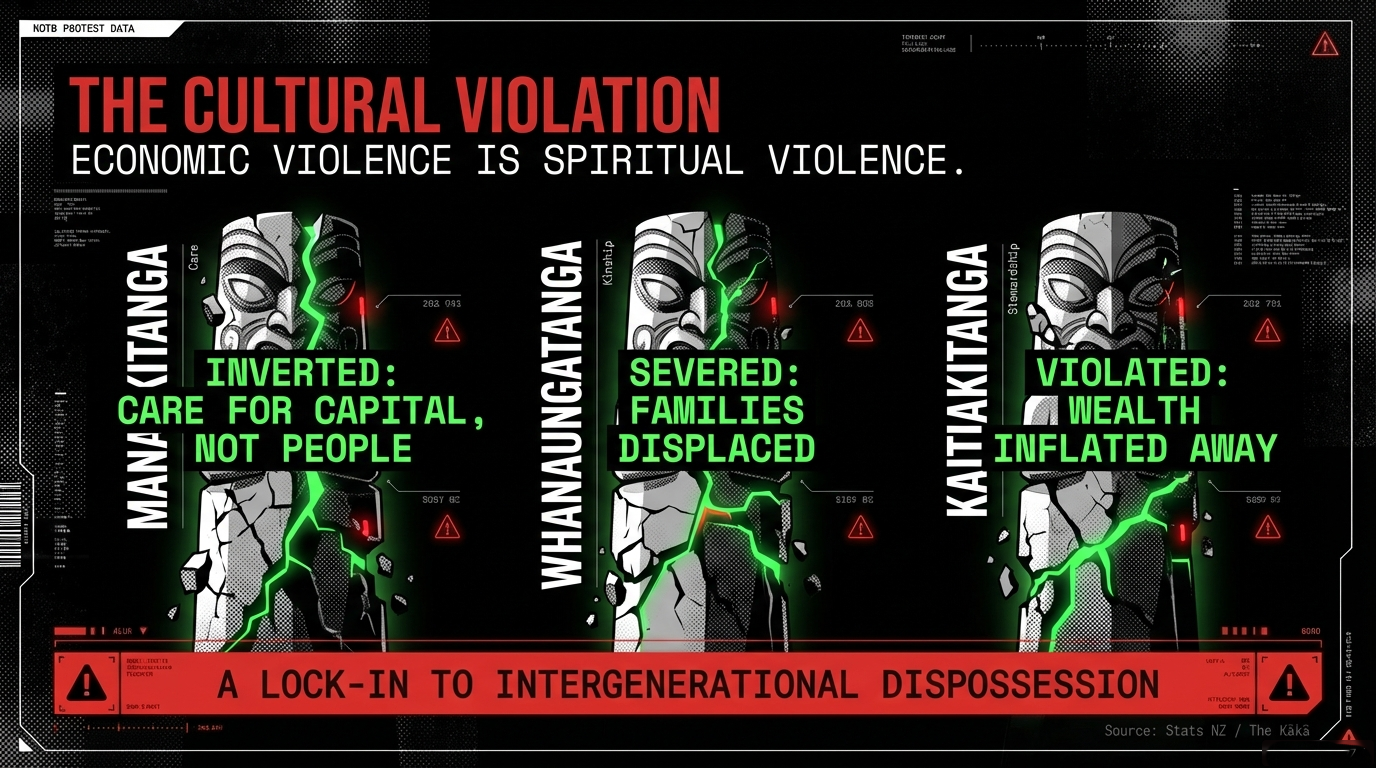

For the Western mind trained to see economics as a neutral science of numbers and graphs, the devastation of Covid-era monetary policy registers as an abstract policy failure. But in te ao Māori, what happened is something far more violent. It is an assault on the foundational principles that hold communities together.

Manaakitanga (The Ethic of Care and Generosity)

Manaakitanga demands that those with power use it to uplift the vulnerable. The RBNZ's money printing was the precise inversion: it used the collective power of the state to shower wealth upon those who already had it. Bernard Hickey documented how $20 billion in cash went to businesses while renters received $48 million. In tikanga terms, this is not merely bad policy — it is the deliberate violation of the host-guest relationship. The Crown, as tangata whenua's treaty partner, wielded its monetary sovereignty as a weapon of extraction rather than care.

For the Western mind: Imagine a hospital that triages patients by wealth — giving oxygen to the rich and aspirin to the poor. That's what quantitative easing did to the New Zealand economy. The "care" was for capital. The neglect was for people.

Whanaungatanga (The Principle of Kinship and Collective Responsibility)

Whanaungatanga teaches that wellbeing is collective — that my house is your house, that my child's hunger is your shame. The housing crisis produced by money printing did not just price individuals out of homes. It fractured whānau structures. When a young Māori couple cannot live near their marae because house prices have tripled, the entire web of whanaungatanga is torn. Grandparents cannot care for mokopuna. Tamariki are disconnected from their tūrangawaewae. The ANZ Ko Tū, Ko Rongo report documented how Māori face not just financial barriers but cultural barriers to banking — including racial bias and lack of Māori representation — that make the wealth exclusion doubly violent.

For the Western mind: Think of it as severing family bonds with a spreadsheet. When housing policy forces families apart geographically, it doesn't just cost money — it destroys the social infrastructure that keeps communities healthy, safe, and whole.

Kaitiakitanga (Guardianship and Intergenerational Stewardship)

Kaitiakitanga demands that we act as guardians, not exploiters — that we leave the world better for those who come after us. Independent economist Shamubeel Eaqub warned the wealth surge created a "generational divide" — "the landed gentry" whose children benefit versus those "locked out" in "a generational lockout." Māori home ownership has been in freefall for three decades: from 71% to 27.5%. This is not a market correction. This is the systematic destruction of intergenerational wealth pathways for tangata whenua — a violation of kaitiakitanga so profound it amounts to economic genocide carried out through interest rate policy and bond purchasing programmes.

For the Western mind: Imagine inheriting nothing. Not because your parents were irresponsible, but because the central bank deliberately inflated away every dollar they saved while making their landlord a millionaire. That's what kaitiakitanga violation looks like expressed in Western economic terms.

THE HIDDEN CONNECTIONS: Five Threads This "Review" Will Never Pull

1. The Bank Profit Pipeline

The $28 billion Funding for Lending Programme went to banks — the same Australian-owned banks that the Commerce Commission found operate as a "stable two-tier oligopoly" with "sustained levels of high profitability compared to their global peers." The money the RBNZ printed was laundered through the banking system into asset prices. The banks took their cut — billions in profit — and passed the inflation cost to whānau.

2. The Luxon Property Empire

Prime Minister Christopher Luxon owns seven properties worth between $21–30 million. He was a direct beneficiary of the asset price inflation Willis now wants to "review." His government has restored interest deductibility for landlords — a $2.9 billion gift — while slashing emergency housing by 75%.

3. The Orr Purge

Willis didn't just wait to launch this review — she spent two years dismantling the RBNZ's independent governance, forcing out Adrian Orr, installing a compliant new governor, and rebuilding the Monetary Policy Committee. She now describes this as "great timing" for a review. Of course it is — she's built the stage, cast the actors, and written the script.

4. The RBNZ Already Reviewed Itself

In September 2025, the Reserve Bank published its own review of pandemic monetary policy. Chief economist Paul Conway admitted they could have tightened earlier but argued the LSAP programme's $10.5 billion in losses were offset by increased tax revenue. Willis dismissed this as the Bank "marking their own homework". But her review's terms of reference focus exclusively on the MPC's decisions and RBNZ analysis — not on the government's fiscal coordination, not on the distributional impact on Māori, and certainly not on the structural racism embedded in the monetary system.

5. The Missing Māori Dimension

The review's terms of reference do not mention Māori. They do not mention tangata whenua, te Tiriti, housing affordability for indigenous peoples, or the distributional impact by ethnicity. In a country where Māori are 61% of the homeless, where 27.5% Māori home ownership stands against 70% Pākehā ownership, where Māori constitute nearly half of the public housing waitlist — the silence is the loudest scream in the document.

SOLUTIONS: Because Scathing Without Substance Is Just Noise

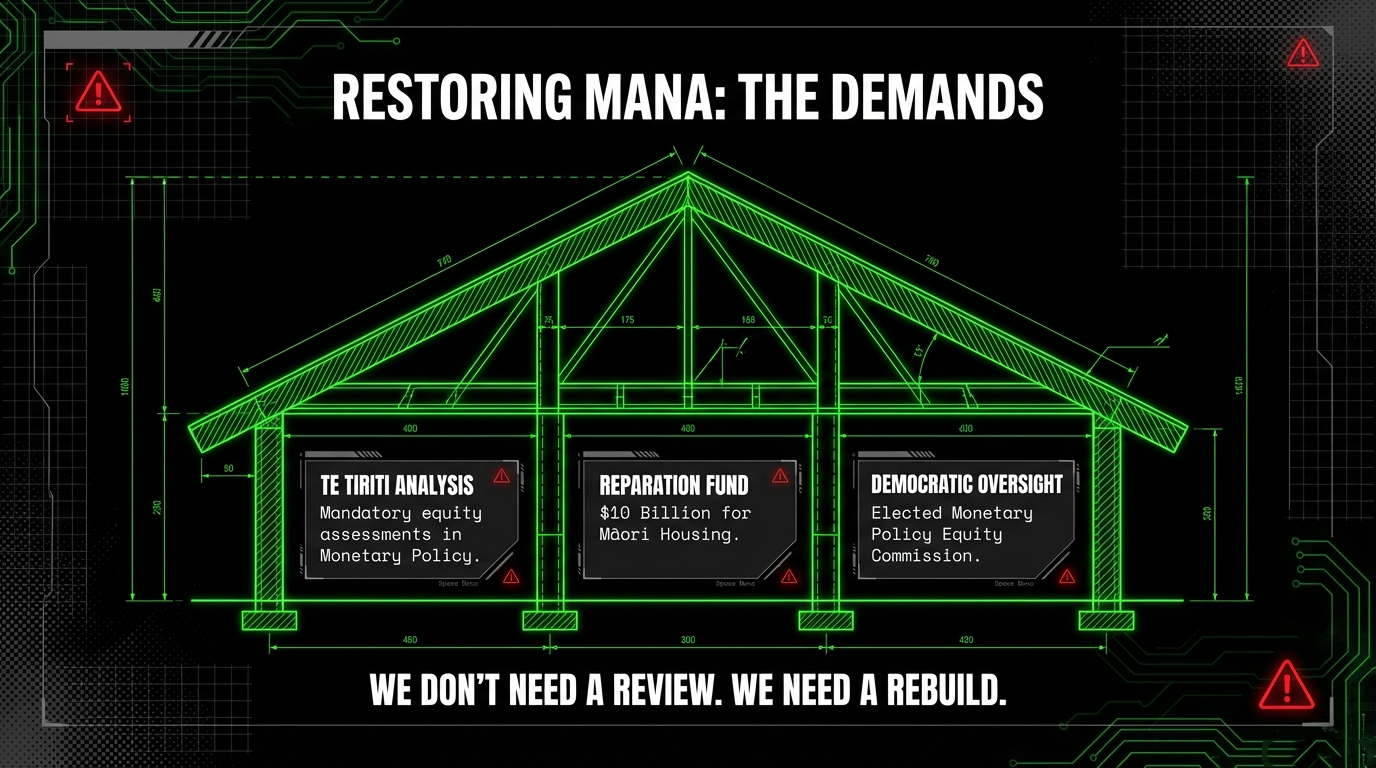

Solution 1: Te Tiriti-Based Monetary Policy Accountability

Any genuine review must include a te Tiriti analysis examining how monetary policy decisions differentially impact Māori. Recommendation: mandate that the RBNZ include a distributional equity assessment — broken down by ethnicity — in every Monetary Policy Statement. If the OCR cut benefits asset owners at the expense of renters, and if renters are disproportionately Māori, the Bank must quantify that harm and propose mitigation.

Solution 2: Sovereign Wealth Reparation Fund

The $10.3 billion in LSAP losses should be matched by a $10 billion Māori Housing Reparation Fund — capitalised from Crown balance sheet recovery and directed to papakāinga development, Māori home ownership pathways, and building on collectively owned whenua Māori. ANZ's Ko Tū, Ko Rongo report provides a framework: banks partnering with iwi to create intergenerational mortgages, transportable home lending, and infrastructure-only lending on Māori land.

Solution 3: Democratic Oversight of Money Creation

Central bank independence should not mean central bank impunity. New Zealand needs a permanent, publicly elected Monetary Policy Equity Commission with power to review RBNZ decisions for distributional fairness before they are implemented — not five years after the damage is done. This commission must include tangata whenua representation at governance level, not as an afterthought.

PREVIOUS COVERAGE BY THE MĀORI GREEN LANTERN

This essay builds on extensive previous investigation into the machinery of economic extraction:

- "Economic Puppeteers Celebrate While Whānau Suffer" (21 August 2025) — exposing how the coalition celebrated OCR cuts while unemployment soared and Māori bore the consequences of monetary policy vandalism.

- "THE HOUSING HEIST: How Chris Bishop's Neoliberal Agenda is Stealing Māori Futures" (29 October 2025) — documenting the $150 million transfer from public to private housing hands and the collapse of Māori home ownership from 71% to 30.4%.

- "Selling Our Homes to Save Them: How Neoliberal Think Tanks Are Weaponising Housing Against Māori" (18 October 2025) — exposing the NZ Initiative's plan to privatise 78,000 state houses.

- "Power Plays in Paradise: How the Prime Minister Secured His Holiday Home While Whānau Freeze" (23 October 2025) — documenting Luxon's $10.5 million holiday home rates reduction while whānau sleep in cars.

- "The Blueprint for Dispossession" (5 November 2025) — tracing the international neoliberal networks running the same playbook from Washington to Wellington.

- "INVISIBLE VIOLENCE: How Christopher Luxon's Government Is Criminalizing Poverty While Profiting from Homelessness" (5 November 2025) — 75% emergency housing cuts, doubled rough sleeping, 985 Housing First waitlist.

- "Reserve Bank Miscommunication Drives Mortgage Rates Higher" (14 December 2025) — RBNZ dysfunction under Willis's "refreshed" governance.

- "The Funding Coup: How the Luxon Government Forced Out Adrian Orr" — the political mechanics behind the RBNZ governance purge.

THE VERDICT

Nicola Willis is not investigating a fire. She is managing the narrative around the fire her ideological allies helped set — a fire that consumed Māori wealth, Māori homes, and Māori futures. The $55 billion in printed money was never designed to reach whānau. It flowed upward, as money always does under neoliberalism: to banks, to bondholders, to the landed gentry. The $10.3 billion in losses? Socialised. Paid by every taxpayer, including the Māori mother working two jobs in South Auckland whose rent doubled because the RBNZ's bond purchases inflated her landlord's portfolio.

This review is a weapon disguised as wisdom. It is election strategy masquerading as accountability. It will find what it is designed to find: that the Labour-era RBNZ made mistakes. It will not find what it is designed to ignore: that the monetary system itself is an engine of colonial wealth extraction, and that this government has spent two years making it worse.

The whare is still burning. The arsonist is holding the clipboard. And whānau Māori are still choking on the smoke.

Mauri ora.

Koha Consideration

Every koha signals that whānau are ready to fund the accountability that $55 billion in printed money was never meant to provide. When the Reserve Bank prints wealth for asset owners and the government launches reviews designed to deflect blame, it is our independent voices — not their handpicked reviewers — that expose the truth.

It signals that rangatiratanga includes the power to fund our own economists, our own analysts, our own truth-tellers — because the monetary policy apparatus that transferred $1 trillion to the wealthy will never audit itself honestly.

Kia kaha, whānau. Stay vigilant. Stay connected. And if you are able, consider a koha to ensure this voice keeps cutting through the smoke of their manufactured "reviews."

If you are unable to koha, no worries! Subscribe or Follow The Māori Green Lantern on Substack, kōrero and share with your whānau and friends — that is koha in itself. Every share exposes another thread in the web of monetary colonisation.

Three pathways exist:

For those who wish to support this mahi directly with a koha (voluntary contribution):

Koha — Support The Māori Green Lantern

For those who wish to receive essays directly and support through subscription:

Subscribe to The Māori Green Lantern

For those who prefer direct bank transfer:

HTDM, account number 03-1546-0415173-000.

Research tools used: search_web, get_url_content, search_files. Sources consulted: RNZ, Stuff, 1News, Interest.co.nz, Bernard Hickey/The Kākā, Stats NZ, Treasury, MSD Housing Register, RBNZ publications, ANZ Ko Tū Ko Rongo report, Commerce Commission, Canterbury University, Waatea News, The Spinoff, ODT, Beehive.govt.nz, Te Puni Kōkiri, The Māori Green Lantern archives (Substack & Ghost). Date of research: 12 February 2026. Unverifiable claims: Composite example "Hine" is representative, not a specific individual. LSAP-to-social-housing equivalence is illustrative calculation.

Ivor Jones The Māori Green Lantern Fighting Misinformation And Disinformation From The Far Right

Comments ()