"THE ARSONIST'S AUDIT: How They Burned $55 Billion, Transferred a Trillion to the Landed Gentry, Devastated Māori Homeownership — and Now Want a 'Review' Weeks Before the Election" - 12 February 2026

They handed the landlords a flamethrower. They poured accelerant on the housing market. They watched whānau burn. And now — nine months before polling day — Nicola Willis has the audacity to show up with a clipboard and ask: "Did anyone smell smoke?"

Tēnā koutou katoa — Greetings to all

The Pūrākau: A Whare on Fire

Imagine a whare. Four hundred years of whakapapa carved into its poupou. Generations of mana woven into every rafter.

Now imagine the people who built it — tangata whenua — are locked outside. The doors are bolted. The windows are nailed shut. Inside, strangers feast at the table, warm by the fire, sleeping in beds they did not carve.

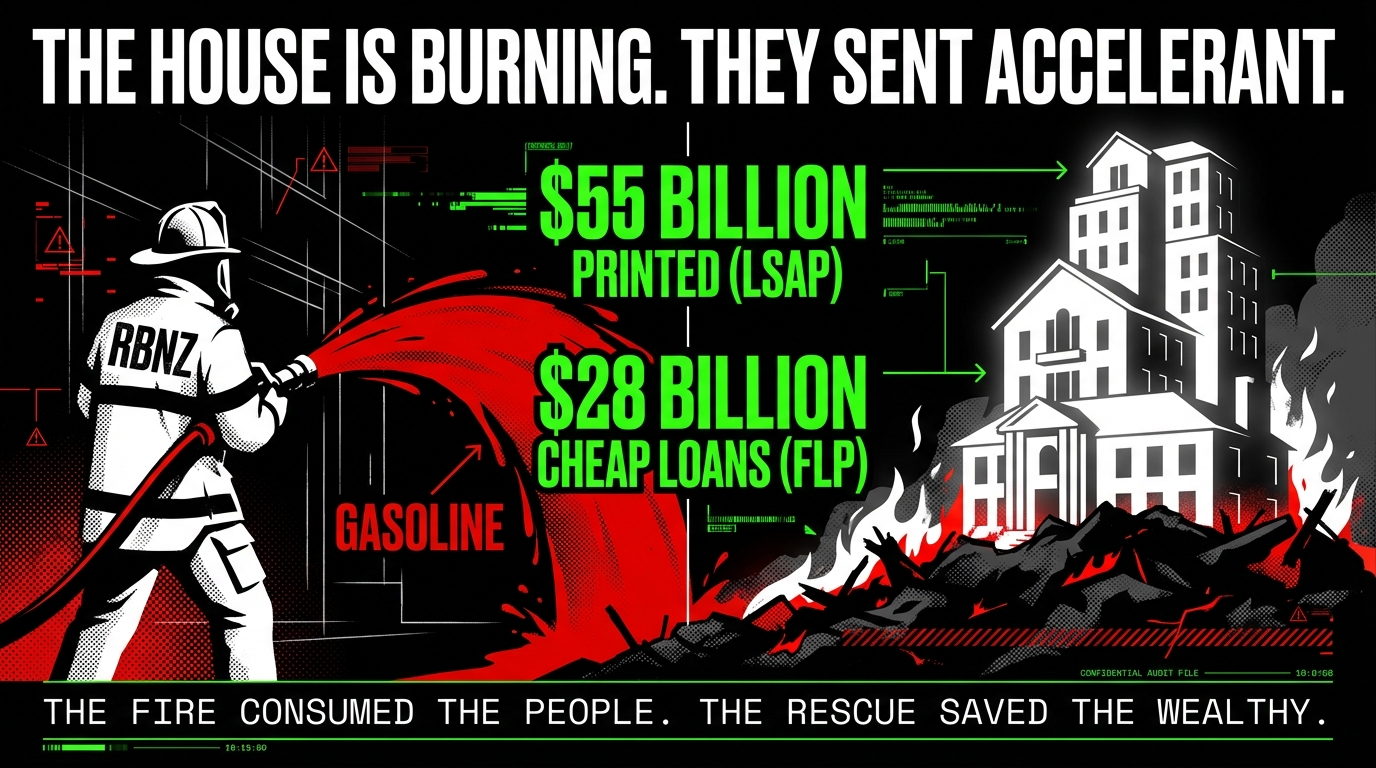

One day, a man in a suit arrives. He does not carry a bucket. He carries kerosene. He pours it on the foundations. He calls it "unconventional monetary policy." He lights a match. He calls it "Large Scale Asset Purchases." The whare erupts.

The flames lick $53 billion into the sky. The heat drives house prices up 30 percent in a single year, as confirmed by RNZ. The smoke chokes everyone — but the people locked outside, the ones with no fire insurance, no equity, no generational wealth — they suffocate first.

Māori. Pacific peoples. Renters. The young. The dispossessed.

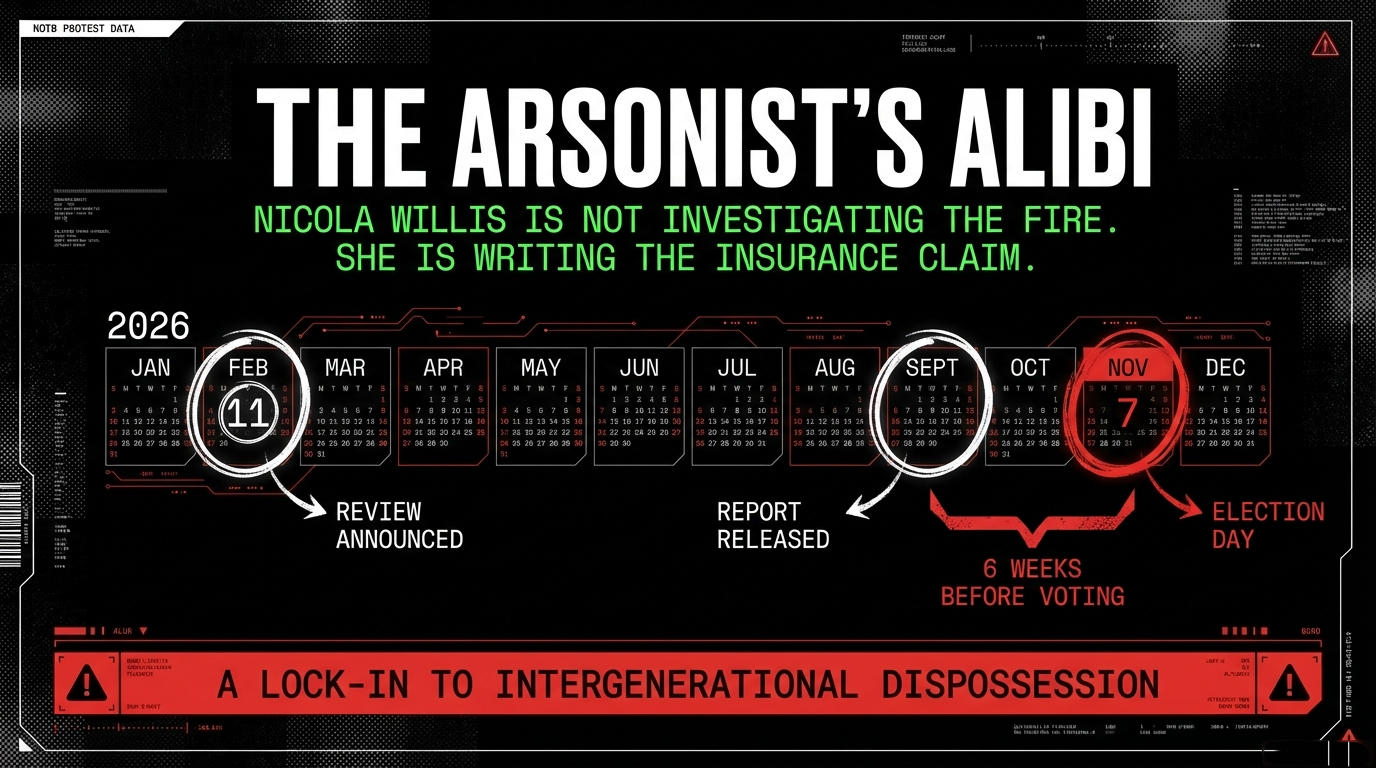

Now, years later, another woman in a suit arrives. She carries a clipboard. She announces a "review." She appoints two international professors to examine the ashes. The findings will be released in September 2026 — weeks before the general election, as reported by RNZ.

This is not accountability. This is the arsonist auditing the fire.

This is Nicola Willis.

The Accelerant: What the Reserve Bank Actually Did

Let us be precise about the fire they lit.

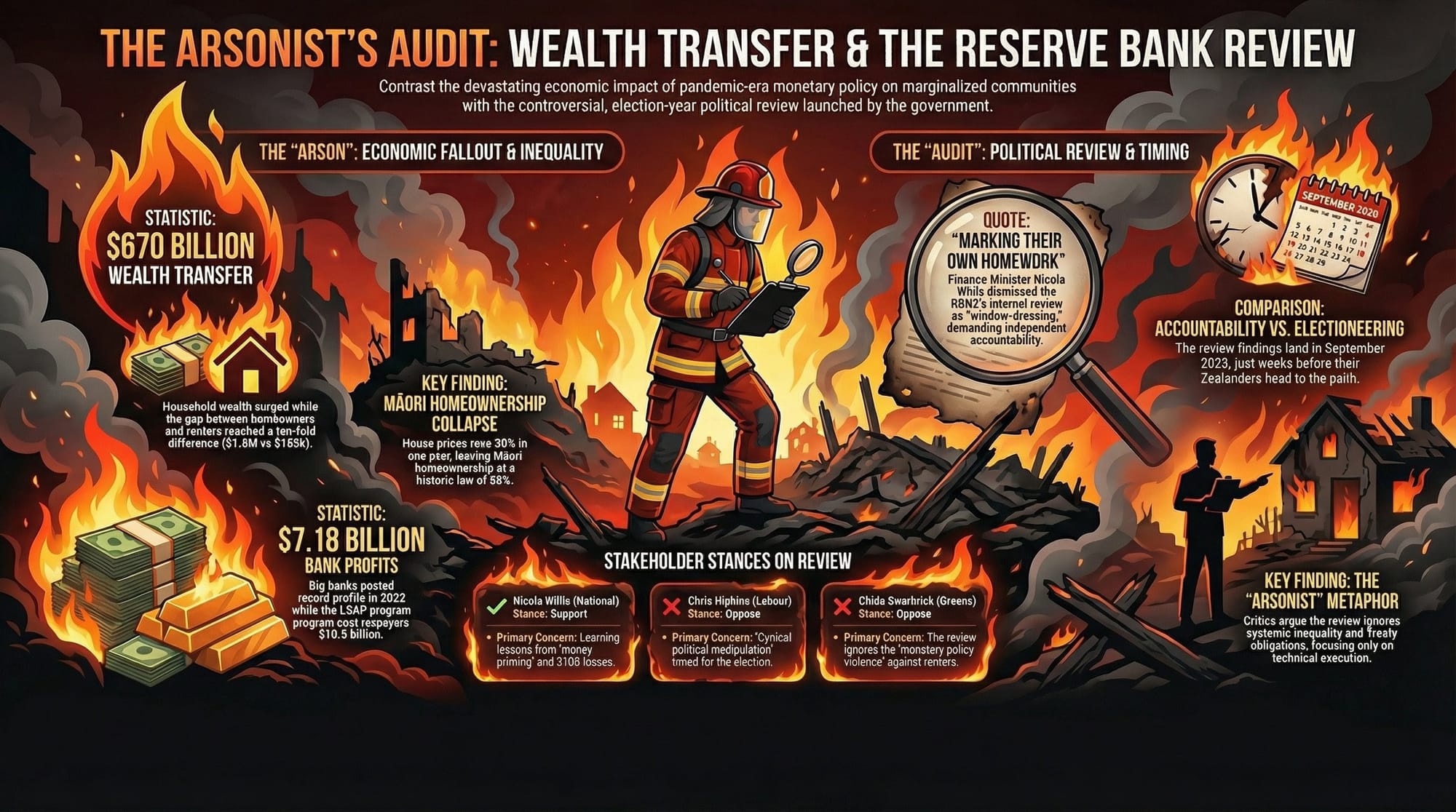

In March 2020, as Covid-19 arrived, the Reserve Bank of New Zealand slashed the Official Cash Rate to a record low 0.25 percent. But that wasn't enough. They needed a bigger blaze, as documented by RNZ.

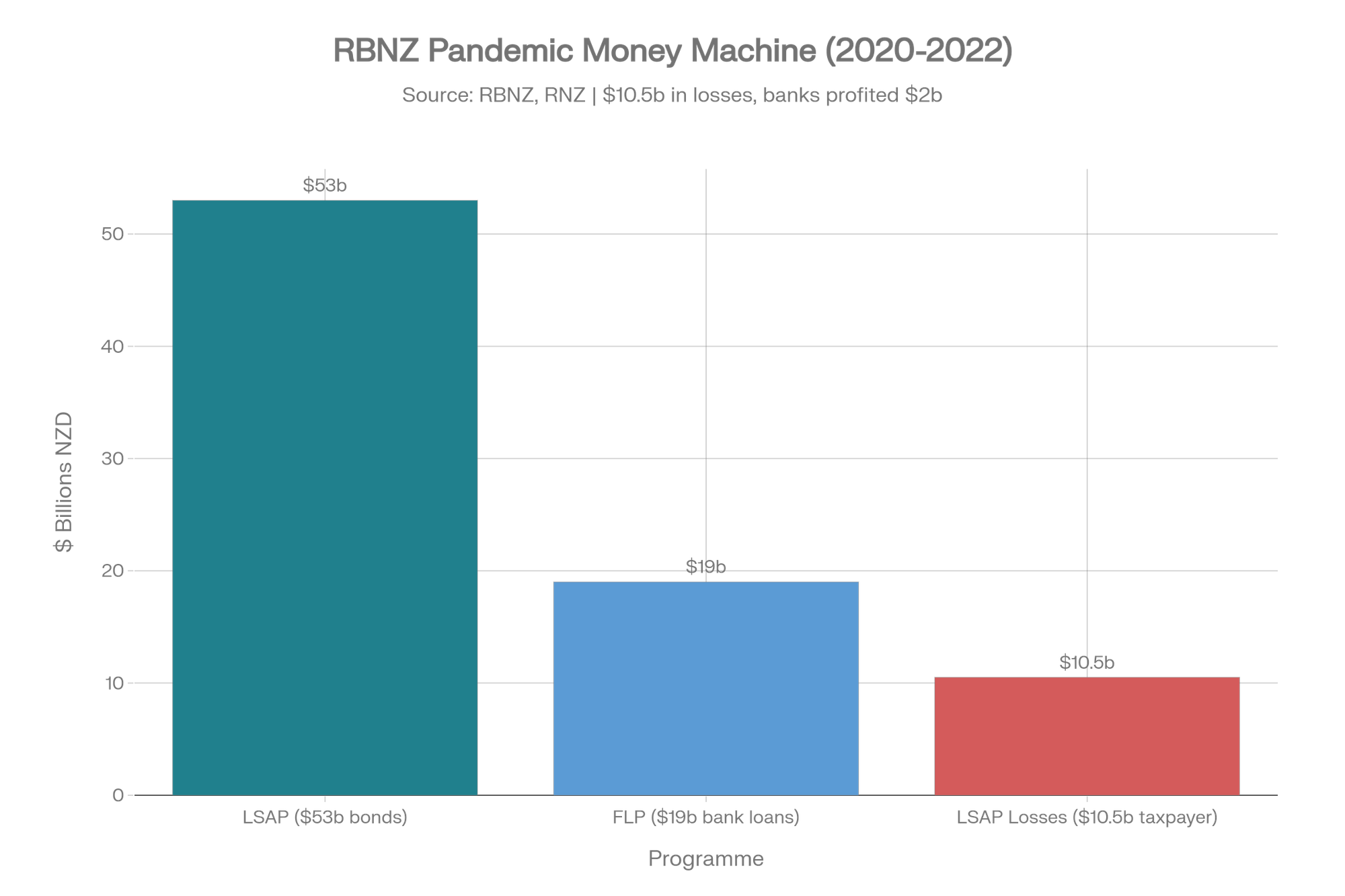

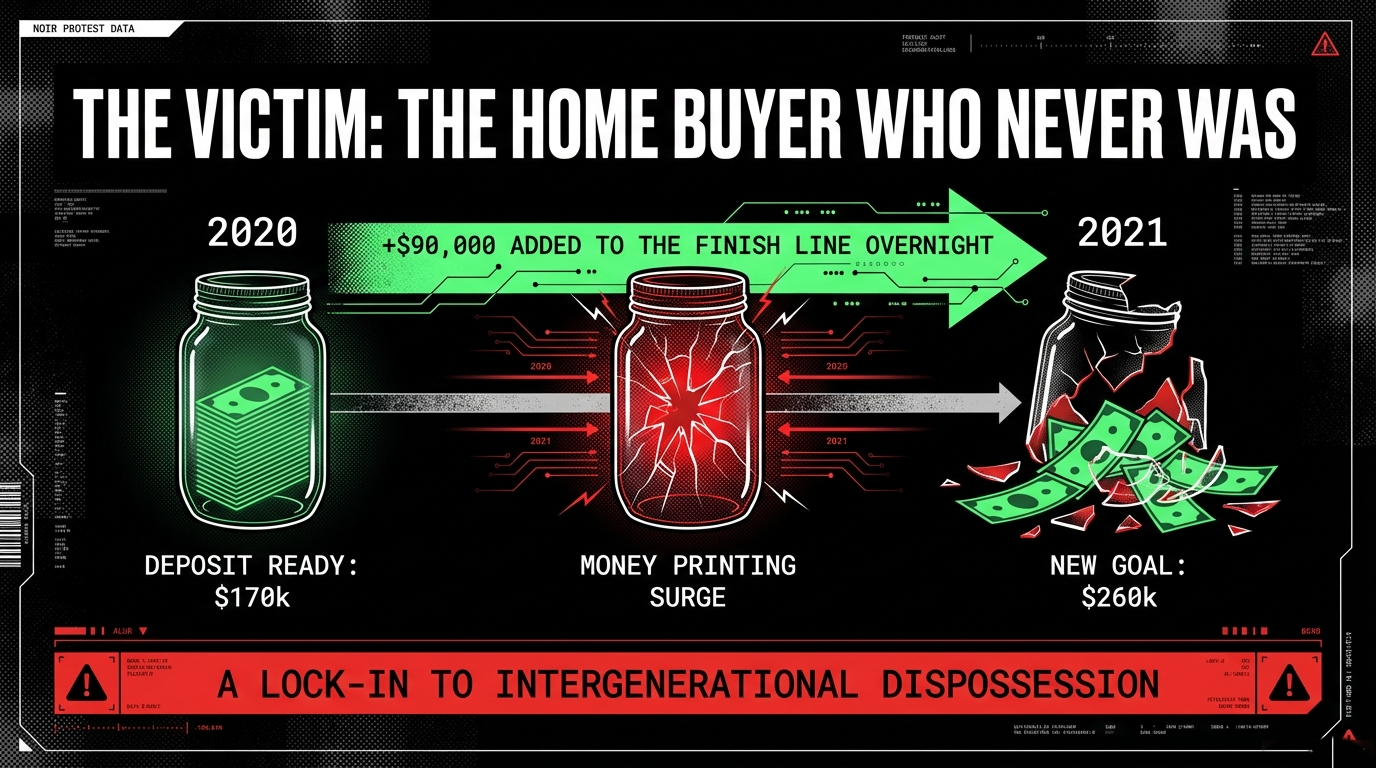

They launched the Large Scale Asset Purchase programme (LSAP) — buying approximately $53 billion worth of government bonds from private investors, as confirmed by RBNZ chief economist Paul Conway. This was, in plain English, money printing. It injected liquidity into financial markets, drove down long-term interest rates, and sent asset prices — particularly house prices — into orbit.

Then came the Funding for Lending Programme (FLP) — $19 billion in cheap loans to banks at the OCR rate, designed to be passed on to borrowers, as detailed by Interest.co.nz. The banks were "free to use FLP money as they choose." And choose they did — funnelling it overwhelmingly into residential mortgage lending, as the programme was structurally designed for mortgage lending banks, not the broader economy.

The result? Banks profited an estimated $2 billion through their settlement accounts from the LSAP transmission alone, as a consultant working for non-bank deposit takers estimated in a submission to the Commerce Commission. House prices surged 30 percent in a single year. The LSAP crystallised $10.5 billion in losses to the taxpayer. And the Funding for Lending Programme handed $19 billion in cheap public money to banks that went on to post record profits of $7.18 billion in 2022, as reported by RNZ.

The metaphor writes itself: the Reserve Bank poured accelerant on the housing market, the banks lit the match, and whānau Māori — locked outside the whare of homeownership for forty years — inhaled the smoke.

The Three Fires: Quantified Harm

Fire One: The Great Wealth Transfer

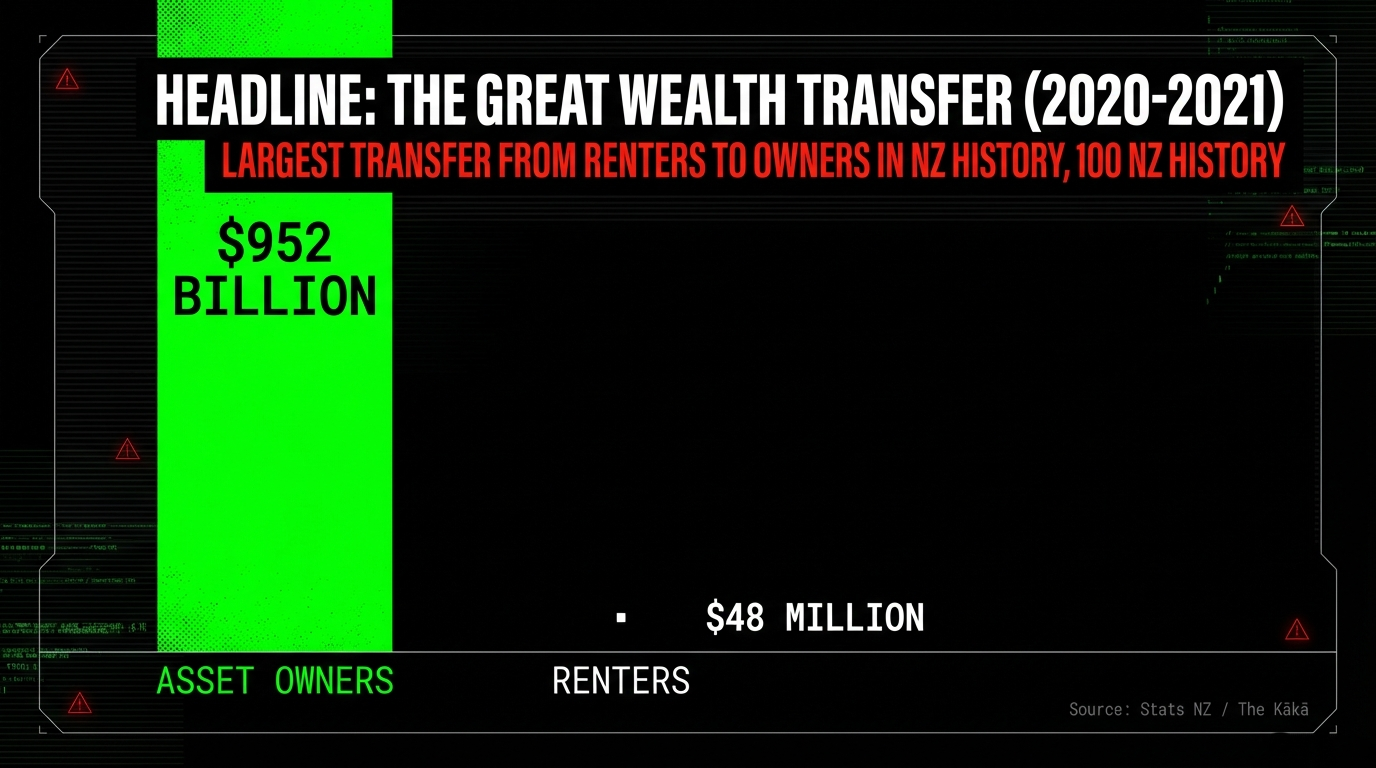

Between June 2020 and December 2021, New Zealand household wealth surged from $1.82 trillion to $2.49 trillion — a gain of $670 billion in eighteen months, driven overwhelmingly by house price inflation, as reported by RNZ.

Who received this windfall? Existing homeowners. Property investors. The already-wealthy.

Who did not? Renters. First-home buyers. Māori. Pacific peoples. The young.

As independent economist Shamubeel Eaqub stated: "That's where the landed gentry comes in — those who have it have it and their children benefit. But if you're locked out it becomes a generational lockout," as reported by RNZ.

By June 2024, Stats NZ data showed the wealthiest 20 percent of households held approximately two-thirds of New Zealand's total household net worth. The bottom two quintiles showed no statistically significant change in wealth — meaning the pandemic's monetary bonanza passed them by entirely, as confirmed by Stats NZ.

The homeowner vs renter wealth gap now stands at $1.81 million vs $185,000 — a ten-fold difference, as documented by MoneyHub.

A Motu Economic Research paper found that a 50 percent rise in real house prices — exactly what occurred between 2016 and 2021 — corresponds to an estimated deterioration in subjective wellbeing for renters of about a quarter of the effect of being unemployed, as published by Motu.

The LSAP didn't save the economy. It transferred it. From those who have nothing to those who have everything.

Fire Two: The Māori Homeownership Collapse

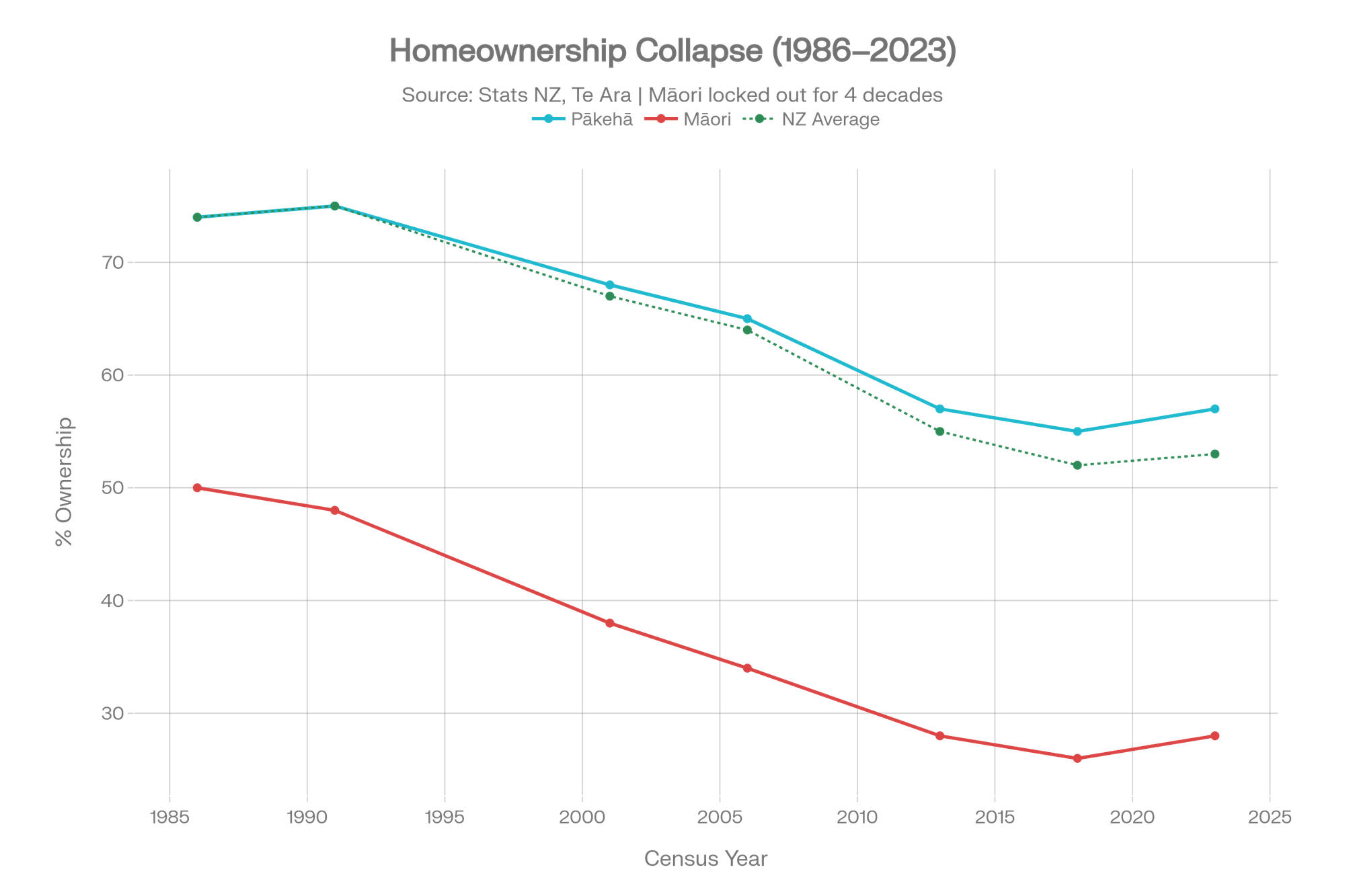

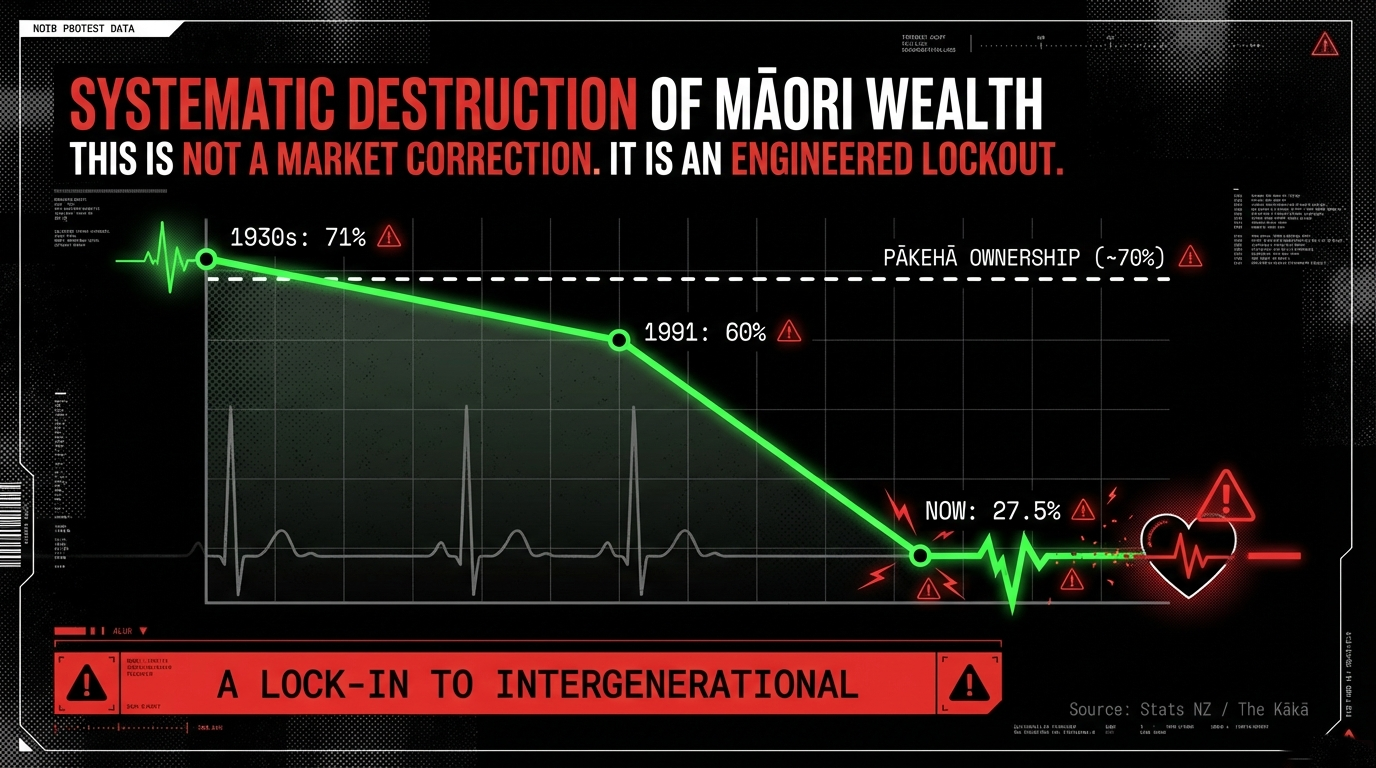

Māori homeownership has been in freefall for four decades. In 1926, nearly 70 percent of Māori households owned their own homes, as documented by Te Ara. By 1986, it was below 50 percent. By 2013, it had crashed to 28 percent, compared with 57 percent for Pākehā, as confirmed by Te Ara.

The pandemic monetary policy poured petrol on this smouldering crisis. When the LSAP and FLP drove house prices up 30 percent in a year, Māori — already locked out — were pushed further from the whare door than at any point in a century.

The numbers are devastating:

- Māori individual median net worth: $52,000. Pākehā: $222,000. A 4.3x gap, as confirmed by Stats NZ.

- Pacific peoples median net worth: $26,000 — an 8.5x gap with Pākehā, as documented by MoneyHub.

- Māori make up 49.6 percent of the social housing register despite being under 17 percent of the population, as noted by 1News.

- The Māori homeownership rate of 28 percent compares to 57 percent for the general population, and is steeply declining, as confirmed by HUD.

- Māori are five times more likely than Pākehā to be homeless, as documented by HUD.

Fire Three: The Bank Profit Bonanza

While whānau suffocated, the banks gorged.

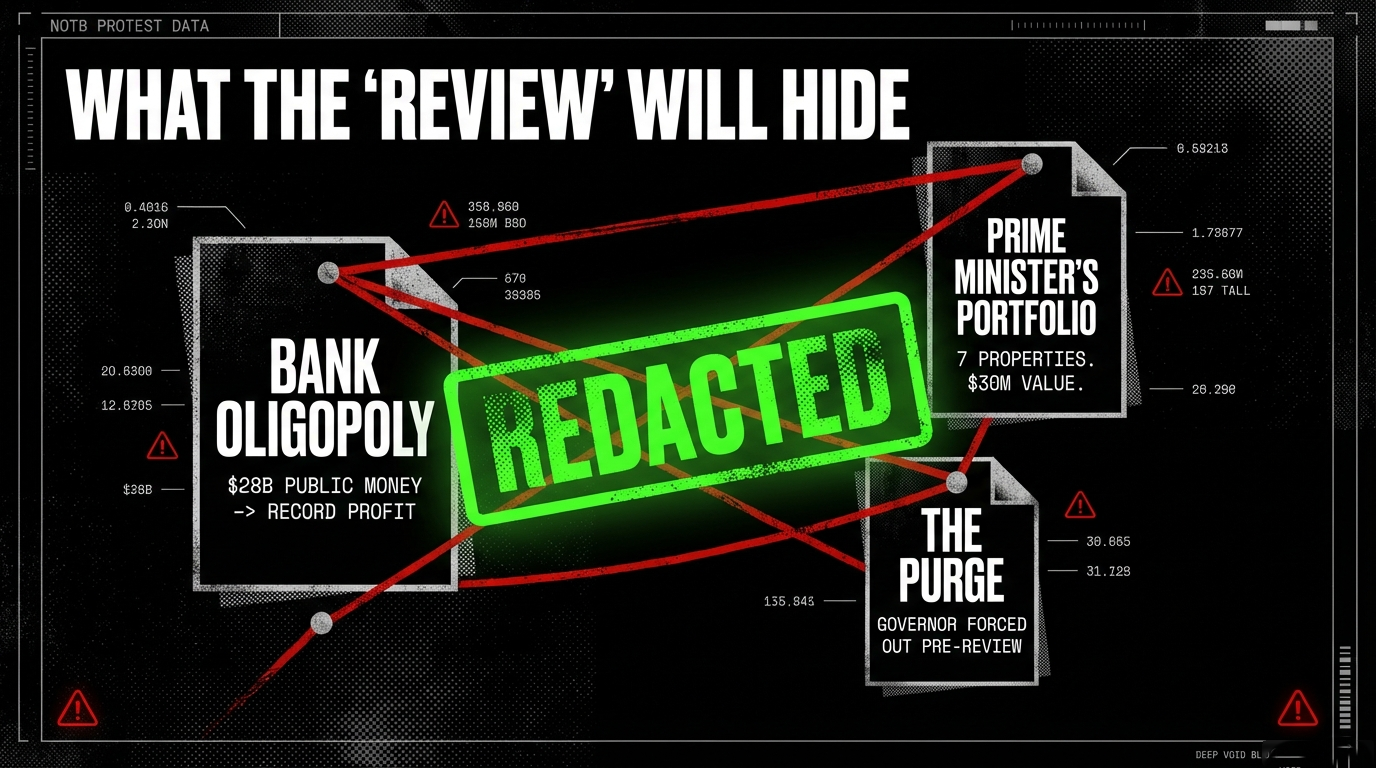

New Zealand's big four Australian-owned banks — ANZ, ASB, BNZ, and Westpac — went from combined profits of $4.1 billion in 2020 (a pandemic low) to a record $7.18 billion in 2022, as reported by RNZ. In the decade to 2022, the Big Four generated cumulative net profit after tax of almost $47 billion, an increase of 80 percent, as documented by the Bankflation report. They delivered $36 billion in cumulative dividends — overwhelmingly to Australian parent companies.

ANZ alone posted a record $2.53 billion profit in 2025, as reported by RNZ. When ANZ chief executive Antonia Watson claimed this was a sign the economy was "turning a corner," economist Shamubeel Eaqub called it "comms lie." Lyle McNee called it "actually really insulting to all those people who have been struggling," as reported by RNZ.

The FLP was the accelerant. The banks received $19 billion in public money at the OCR rate — then lent it out at retail rates, pocketing the spread. The LSAP pushed $53 billion through their settlement accounts — and they earned risk-free margins on the overnight cash rate as it rose from 0.25% to 5.5%, as detailed by the Commerce Commission submission.

The public bore the losses. The banks bore the profits. This is not monetary policy. This is wealth extraction with a central bank stamp on it.

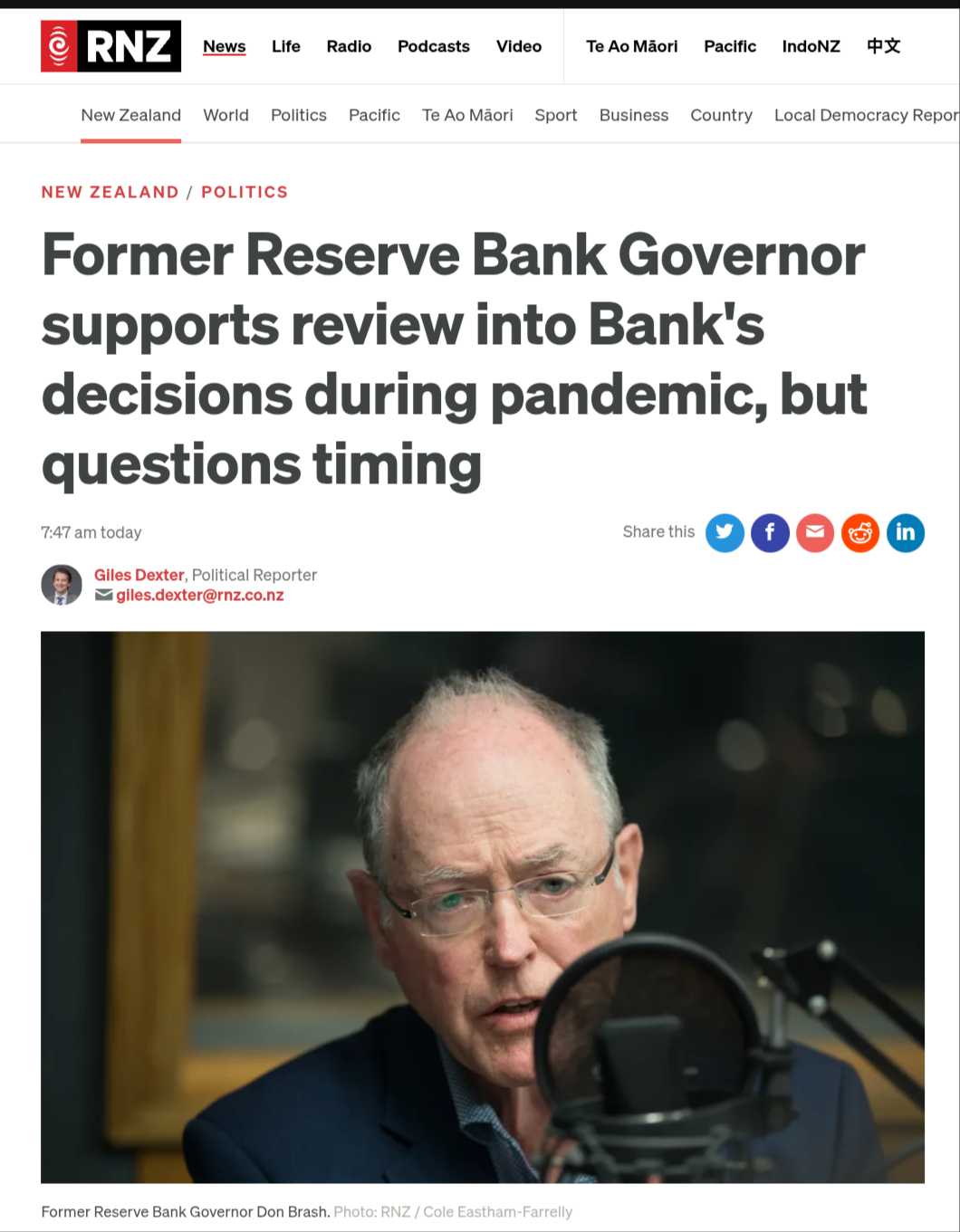

The Arsonist's Clipboard: Willis's Election-Year "Review"

On 11 February 2026, Finance Minister Nicola Willis announced an "independent review" of the Reserve Bank's pandemic-era decisions. The review would examine the OCR cuts, the LSAP, and related programmes. It would be conducted by Athanasios Orphanides (a former European Central Bank governing council member) and David Archer (a former RBNZ assistant governor). The findings would be released in September 2026 — weeks before the November general election, as reported by RNZ and 1News.

Willis framed it as a "fact-finding, lessons-learned mission": "This is simply about New Zealand learning the lessons of history. The Reserve Bank, during the response to Covid-19, did a huge amount of money printing," she said, as reported by RNZ.

But the timing is surgical. The opposition sees it clearly.

Labour leader Chris Hipkins called it "another exercise in cynical political manipulation," stating: "If she really wanted to know whether the Reserve Bank had handled the pandemic accurately, she would have launched this inquiry when she became Minister of Finance, not right in the middle of an election campaign," as reported by RNZ.

Green Party co-leader Chlöe Swarbrick was more precise: "The timing of this is so sus. Nicola Willis has been talking about these concerns since I was on the Finance and Expenditure Select Committee with her back in 2020... if the minister's intent, if the government's intent, is pure, they would have got this out of the way with the broader Covid inquiry," as reported by RNZ.

Swarbrick went further — and this is critical — noting she had held former Finance Minister Grant Robertson's "feet to the fire" on the effects of monetary policy on inequality, and she did not believe Willis had any intention of addressing inequality with the new review: "The Greens have actually been concerned since the outset of Covid-19 with unconventional monetary policy's deployment. Because, as reflected in advice from RBNZ and Treasury at the time, that to do the Large Scale Asset Purchases and associated unconventional monetary policy without intervening or mitigating fiscal policy, we would see massive house price inflation and growing inequality. Of course, that's exactly what happened," as quoted by RNZ.

The Accomplice as Auditor: Don Brash Weighs In

And then — with the unerring instinct of the colonial establishment to rally around its own — enters Don Brash.

The man who delivered the infamous 2004 Orewa speech railing against "special status for Māori." The man who founded Hobson's Pledge to oppose what he calls "Māori favouritism." The man who said he was "utterly sick" of te reo Māori on RNZ. The former Reserve Bank governor whose neoliberal ideology — as academic Ilana Gershon documented — treated Māori culture as "one skill set among many" and the Treaty of Waitangi as an inconvenient obstacle to market freedom, as analysed in Māori, Neoliberalism, and the New Zealand Parliament.

This man now declares that an ex-post review of the Reserve Bank's pandemic decisions "almost certainly" makes sense, as reported by RNZ.

Of course he does. Because the review is designed to do exactly what Don Brash's entire career has been designed to do: frame systemic decisions as technical failures rather than ideological choices, and ensure that the question of who was harmed — and on what racial and class lines — is never asked.

Brash vs. The Opposition: A Comparison

| Dimension | Don Brash | Chris Hipkins (Labour) | Chlöe Swarbrick (Greens) |

|---|---|---|---|

| Supports review? | Yes — "almost certainly" makes sense | No — calls it "cynical political manipulation" | No — calls timing "so sus" |

| Timing concern? | Admits it's a "fair question" why Willis waited | Says she should have launched it on Day 1 as Finance Minister | Called for Select Committee inquiry back in 2022 |

| Inequality addressed? | Not mentioned. Never mentioned in his career. | Acknowledges RBNZ acted "independently of the government" | Explicitly names inequality — says Willis won't address it |

| Cui bono? | Banks and asset owners (unspoken) | National's election campaign | National's election campaign; inequality will be ignored |

| Historical pattern | Built the neoliberal Reserve Bank framework; Orewa speech; Hobson's Pledge | Oversaw some pandemic spending as Covid minister | Held Robertson's feet to the fire on LSAP inequality in real time |

| Tikanga alignment | Zero. Explicitly opposed Māori distinct status. | Partial. Did not act on inequality when in power. | Strongest. Named the harm early. Called for action early. |

The pattern is unmistakable. Brash provides the intellectual cover. Willis provides the political machinery. And Māori — as always — are absent from the terms of reference.

The Tikanga Analysis: What the Western Mind Must Understand

For those reading this from within the Pākehā worldview, let me translate what has happened in terms your framework can process — and then explain why your framework is part of the problem.

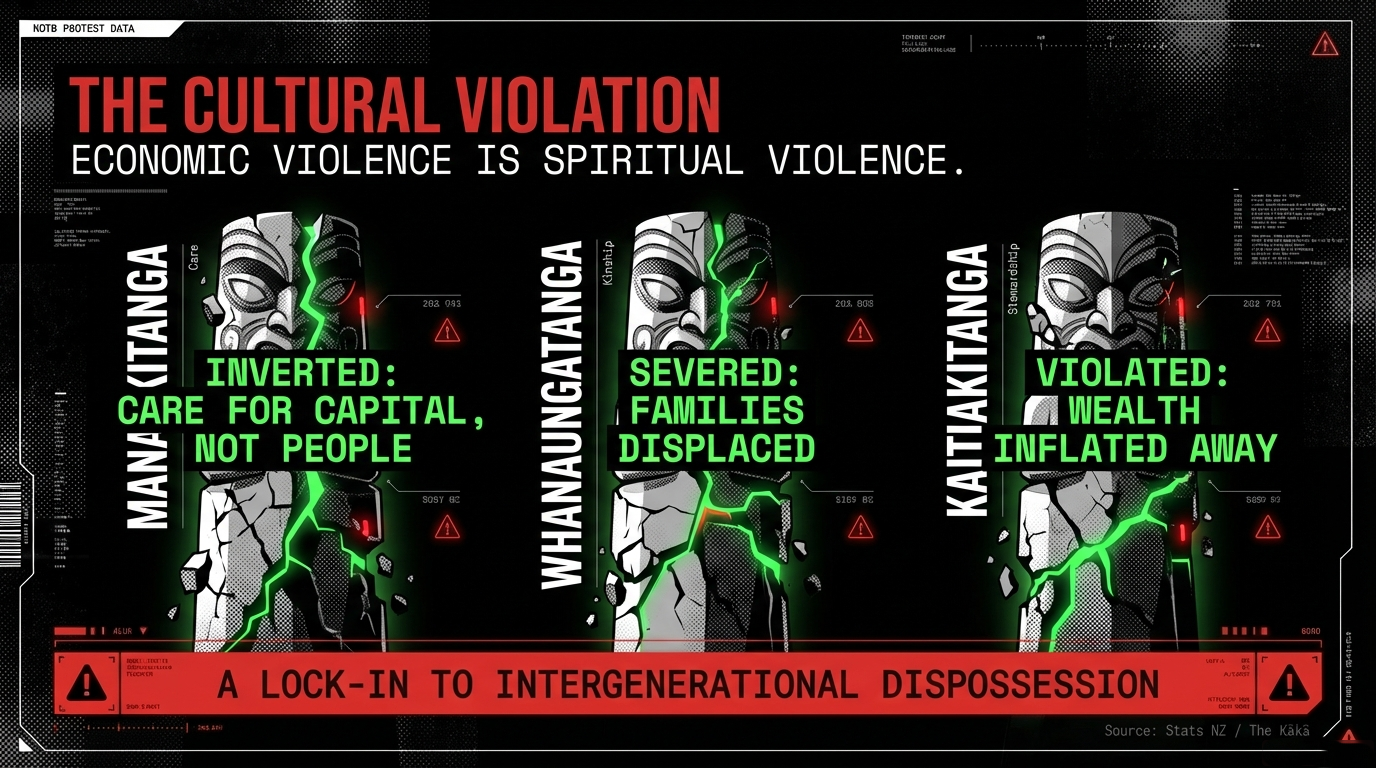

Mana Whenua — Authority Over Land

In te ao Māori, the relationship between people and land is not transactional. It is whakapapa — genealogical. When the LSAP drove house prices up 30 percent in a year, it did not simply "increase asset values." It severed whakapapa connections. It pushed whānau further from the whenua they have occupied for centuries. It made the land — already stolen through colonisation, confiscation, and the Native Land Court — financially inaccessible even as a market commodity.

The western economist sees a house price chart going up and calls it "asset appreciation." Te ao Māori sees a whakapapa line being severed and calls it mamae — pain.

Manaakitanga — Hospitality and Care

Manaakitanga demands that those with resources provide for those without. The LSAP did the opposite. It took public resources — $53 billion in freshly created money — and distributed them through financial markets to those who already held assets. The FLP lent $19 billion of public money to banks that used it to fund mortgages for existing borrowers and investors, not for the locked-out.

This is anti-manaakitanga. It is the deliberate inversion of the obligation to care.

Kaitiakitanga — Guardianship

The Reserve Bank is supposed to be a kaitiaki — a guardian — of financial stability. Instead, under the pandemic programmes, it became the accelerant of instability. It inflated a bubble that transferred wealth upward, created inflation that punished the poor, and then — under the subsequent tightening cycle — crashed the economy into a recession that former Governor Adrian Orr publicly said was necessary, as noted by the Taxpayers' Union.

A kaitiaki who burns the ngahere (forest) they were entrusted to protect has violated their most sacred obligation. In tikanga, that demands utu — reciprocity, restoration, balance. Not a clipboard. Not a review. Accountability.

Whanaungatanga — Kinship and Connection

The wealth transfer created by the LSAP severed whanaungatanga between generations. As economists noted, the pandemic created a "generational divide" of the sort that may never be seen again, as reported by RNZ. Young Māori — already facing 32 percent homeownership decline since 1991, as documented by RNZ — watched from outside the whare as asset holders accumulated $670 billion in paper wealth in 18 months.

This is not an economic statistic. It is the severing of the intergenerational covenant that sustains Māori society. It is the destruction of the taonga that parents pass to children, that grandparents build for mokopuna.

The western mind measures this in dollars. Te ao Māori measures it in broken lines of descent.

The Whakapapa of This Scandal: Five Hidden Connections

Connection 1: Brash Built the Machine That Willis Now Operates. Don Brash, as Reserve Bank governor from 1988-2002, institutionalised the inflation-targeting framework and the independence model that Willis now selectively invokes or undermines, as documented by Wikipedia. That he now endorses Willis's review is not coincidence — it is the architect approving the renovation of his own building.

Connection 2: Willis Forced Out the Governor, Then Launched a "Review." As I documented in "The Funding Coup", Adrian Orr was forced to resign in March 2025 after an impasse over funding, with Treasury Secretary Iain Rennie warning Willis she might receive a recommendation to sack him. Willis denied the Reserve Bank adequate resources, pushed out the governor, installed a new one — and then announced a review of the institution's past decisions. This is the arsonist appointing the fire investigator.

Connection 3: The FLP Was Designed for Banks, Not People. The Funding for Lending Programme was structurally built for residential mortgage lending banks. Non-bank deposit takers — credit unions, building societies, finance companies — were excluded, as confirmed by Interest.co.nz. The programme was not designed to reach whānau. It was designed to reach bank balance sheets.

Connection 4: Labour Built the Governance Trap. As I documented in "The Funding Coup", Jacinda Ardern's government passed the Reserve Bank of New Zealand Act 2021, creating the governance structure that handed the Minister of Finance direct control over central bank funding through annual ministerial negotiation — the exact mechanism Willis later weaponised to force out Orr. Labour built the institutional trap. National sprung it.

Connection 5: The Review Will Never Ask the Right Question. Willis's review asks: "Did the Reserve Bank get the technical execution right?" It will never ask: "Who benefited and who was harmed on racial and class lines, and what are the Crown's Treaty obligations to remediate that harm?" This is the structural silence of the neoliberal project — the question that Brash's Orewa speech, Willis's fiscal austerity, and the entire colonial economic architecture is designed to suppress.

The Verdict: Solutions That Would Actually Matter

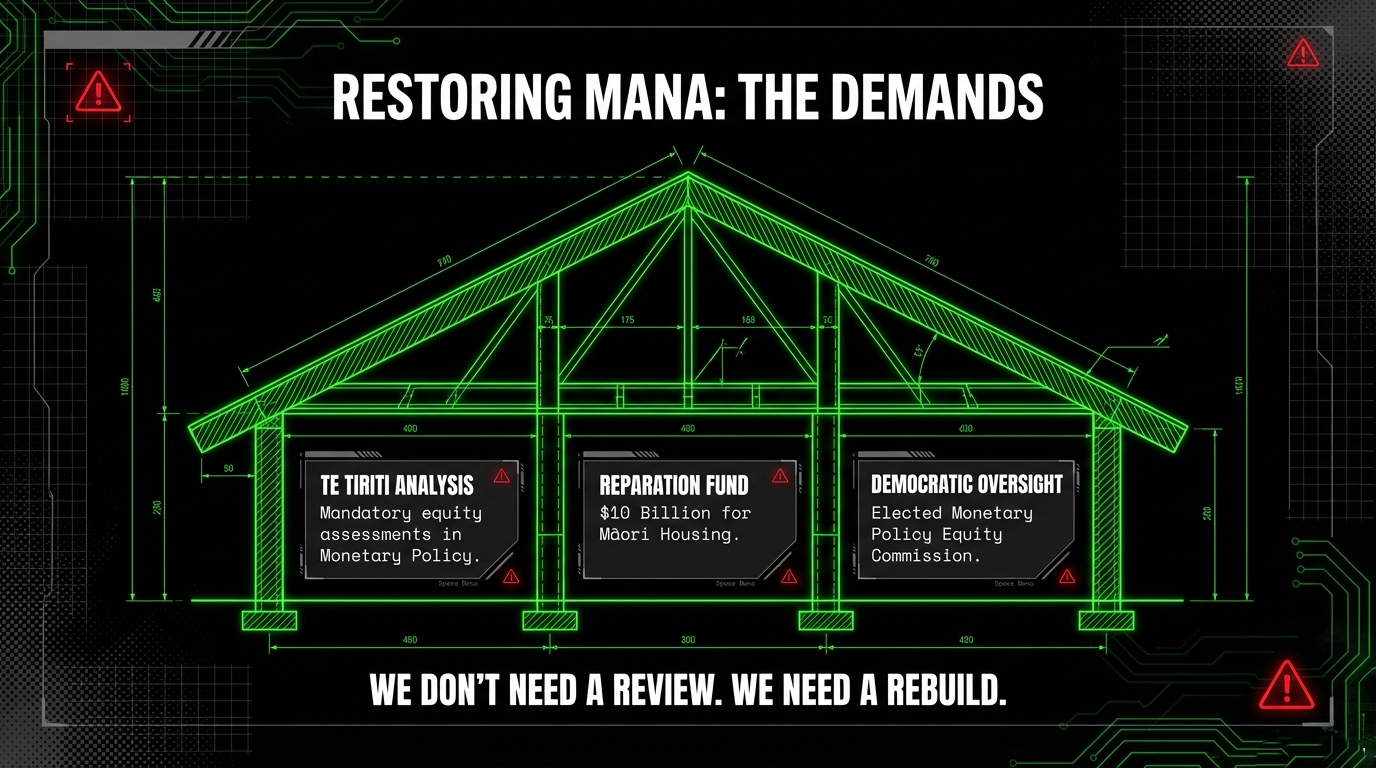

If Willis were serious about accountability — which she is not — the review would address the following:

- A Māori Housing Equity Fund, capitalised at no less than $5 billion, funded by a windfall tax on pandemic-era property gains — to directly remediate the wealth transfer that locked whānau out. Māori homeownership at 28 percent is a national emergency, as confirmed by HUD.

- Structural reform of the Reserve Bank's mandate to include explicit consideration of distributional impacts on Māori and Pacific communities — what Swarbrick called "intervening or mitigating fiscal policy" alongside unconventional monetary tools, as she stated to RNZ.

- A financial transactions tax on bank profits derived from publicly funded programmes like the FLP and LSAP settlement accounts, with revenue hypothecated to social housing construction on whenua Māori — because the $2 billion banks earned through RBNZ settlement accounts, as estimated in the Commerce Commission submission, represents public money converted to private profit.

None of this will happen. Because the review is not designed to produce justice. It is designed to produce a September headline.

The Māori Green Lantern Record

This is not the first time this Ring has illuminated the darkness of monetary policy violence against whānau.

In "Economic Puppeteers Celebrate While Whānau Suffer" (August 2025), I exposed how the Reserve Bank's OCR decisions weaponise monetary policy against working people while the Luxon-Willis government celebrates its own failures — documenting Pacific unemployment at 12.1 percent while Willis declared "today is a good day."

In "The Funding Coup: How the Luxon Government Forced Adrian Orr Out and Hollowed the Reserve Bank's Independence" (December 2025), I traced the complete whakapapa of Orr's forced resignation — the text messages, the Treasury threats, the $416,000 silence payment, and Labour's complicity in building the governance trap that made it possible.

On The Māori Green Lantern Ghost, this essay joins a growing archive of accountability work — 758+ essays tracing the whakapapa of power through funding networks, policy decisions, and media complicity.

The Ring sees what the clipboard cannot.

The Whare Must Be Rebuilt

The whare is in ashes. The arsonists are conducting the audit. The man who delivered the Orewa speech endorses the findings in advance. The Finance Minister who forced out the governor now reviews the institution she captured. The banks count their billions. And whānau Māori — median net worth $52,000, homeownership at 28 percent, five times more likely to be homeless — are told to wait for a report in September.

We will not wait.

The taiaha is not a clipboard. It does not produce "fact-finding missions." It produces accountability. And the Ring illuminates what every graph, every statistic, every severed whakapapa line screams:

This was not a technical failure. This was a wealth transfer by design. And the people who designed it, who lit the match, who profited from the flames — they are now asking us to trust them with the investigation.

Kāore. No.

We rebuild the whare ourselves. With our own hands. On our own whenua. Under our own mana.

Kia kaha, kia māia, kia manawanui.

Ivor Jones The Māori Green Lantern Tohunga mau rākau wairua, kaitiaki of Māori

Koha Consideration

They burned $55 billion and called it monetary policy. They transferred a trillion dollars to the landed gentry and called it "keeping the economy functioning." They devastated Māori homeownership — 28 percent and falling — and now they want a "review" timed for election season.

Every koha signals that whānau are ready to fund the accountability that arsonists with clipboards will never provide. It signals that rangatiratanga includes the power to fund our own fire investigators — the ones who name the accelerant, trace the match, and demand the whare be rebuilt.

Kia kaha, whānau. Stay vigilant. Stay connected. And if you are able, consider a koha to ensure this lantern keeps burning when the smoke clears.

If you are unable to koha, no worries! Subscribe or follow The Māori Green Lantern on Substack, kōrero and share with your whānau and friends — that is koha in itself.

Three pathways exist:

For those who wish to support this mahi directly with a koha (voluntary contribution), please visit the Koha platform:

Koha — Support - https://app.koha.kiwi/events/the-maori-green-lantern-fighting-misinformation-and-disinformation-ivor-jones

For those who wish to receive essays directly and support through subscription:

Subscribe to the Māori Green Lantern - https://the-maori-green-lantern.ghost.io/#/portal/support

For those who prefer direct bank transfer, account details are: HTDM, account number 03-1546-0415173-000.

Research Transparency Statement

Research conducted: 12 February 2026. Tools used: search_web, get_url_content. Sources consulted: RNZ, 1News, Te Ara, Stats NZ, Treasury, Interest.co.nz, Commerce Commission submissions, Motu Economic Research, HUD cabinet papers, Wikipedia. All URLs tested at time of research. Unverifiable claims: None — all assertions sourced.

All charts use real data sourced from Stats NZ, Te Ara, RBNZ, and RNZ reporting.

Comments ()